Hotel Metasearch: Guide to Metasearch Marketing for Hotels

Sep 21, 2025

Mika Takahashi

Mika TakahashiPopular Categories

Hotel Technology & InnovationHotel Operations OptimizationDigital MarketingIndustry TrendsRevenue ManagementHospitality Industry

Popular Categories

Trending Post

Hotel Walk Letter Template: Professional Guest Communication

Online Travel Agents: What They Are and How They Work

Hotel Security Systems: Modern Protection Solutions

Hotel Advertising: Complete Guide to Boost Bookings and Revenue

25 Hotel Marketing Strategy Ideas for 2025: Complete Guide

AI Reservation Agent: Revolutionizing Hotel Booking and Guest Experience

PMS Communication: Streamlining Property Management Through Effective Guest Messaging

Table of contents

Hotel metasearch has quickly become a powerhouse in the travel world, handling over 30% of hotel booking traffic worldwide. As travelers look for transparency and the best deals, metasearch engines have become the go-to spots to compare hotel rooms, prices, and booking options from a variety of sources—all in one place.

If you’re a hotel owner or a revenue manager, getting a solid grasp on hotel metasearch marketing isn’t just a nice-to-have anymore—it’s a must. It helps you boost direct bookings, cut down reliance on online travel agencies (OTAs), and ultimately grow your revenue. This all-in-one guide will walk you through everything you need to know to thrive in the ever-changing world of metasearch advertising.

Whether you’re running a cozy independent hotel or managing a big chain, you’ll learn how to navigate metasearch campaigns, fine-tune your listings for better visibility, and use proven strategies to attract more direct bookings—all while keeping your costs in check.

What Exactly Is Hotel Metasearch?

Think of hotel metasearch engines as specialized platforms that gather and compare real-time hotel prices, availability, and details from many booking sources, including OTAs and hotel websites. Unlike regular search engines that index web pages, these platforms focus solely on travel inventory, pulling data from hundreds of booking channels to give travelers a clear, side-by-side look at their options.

Travelers can quickly compare rates, amenities, reviews, and policies all in one place. This level of transparency has completely changed how guests research and book their stays, shifting the power from individual booking sites to these handy aggregators.

Some of the big names you’ll recognize include Google Hotel Ads (which holds a whopping 67% market share), TripAdvisor, Trivago, KAYAK, and Skyscanner. Each of these platforms draws millions of daily searches from travelers actively hunting for hotel rooms, making them essential channels for hotels looking to get noticed.

The main difference between metasearch and traditional booking sites? When users find a hotel on a metasearch engine, they click through to complete their booking on the hotel’s website or an OTA—not on the metasearch site itself. This setup gives hotels a great chance to snag direct reservations while leveraging the massive reach of these comparison platforms.

How Do Hotel Metasearch Engines Actually Work?

When a traveler enters their destination and travel dates, metasearch engines quickly gather rates from lots of booking sources—OTAs, hotel websites, global distribution systems—and display the results all in one spot.

These listings come packed with photos, guest reviews, room types, cancellation policies, amenities, and prices from different channels. This detailed info helps travelers make smart choices and gives hotels plenty of chances to highlight what makes their property special.

Behind the scenes, there’s a real-time auction that decides which ads get top spots based on things like bid amounts, how competitive the rates are, and the quality of the listing. Metasearch engines use sophisticated algorithms that balance a smooth user experience with revenue goals, favoring listings that are accurate and competitively priced.

Most platforms use a cost-per-click (CPC) model, where hotels pay for each click regardless of whether the booking happens. Some still offer commission-based options, but the trend is moving strongly toward CPC. For example, Google is phasing out commission-based bidding entirely by February 2025, focusing solely on pay-per-click.

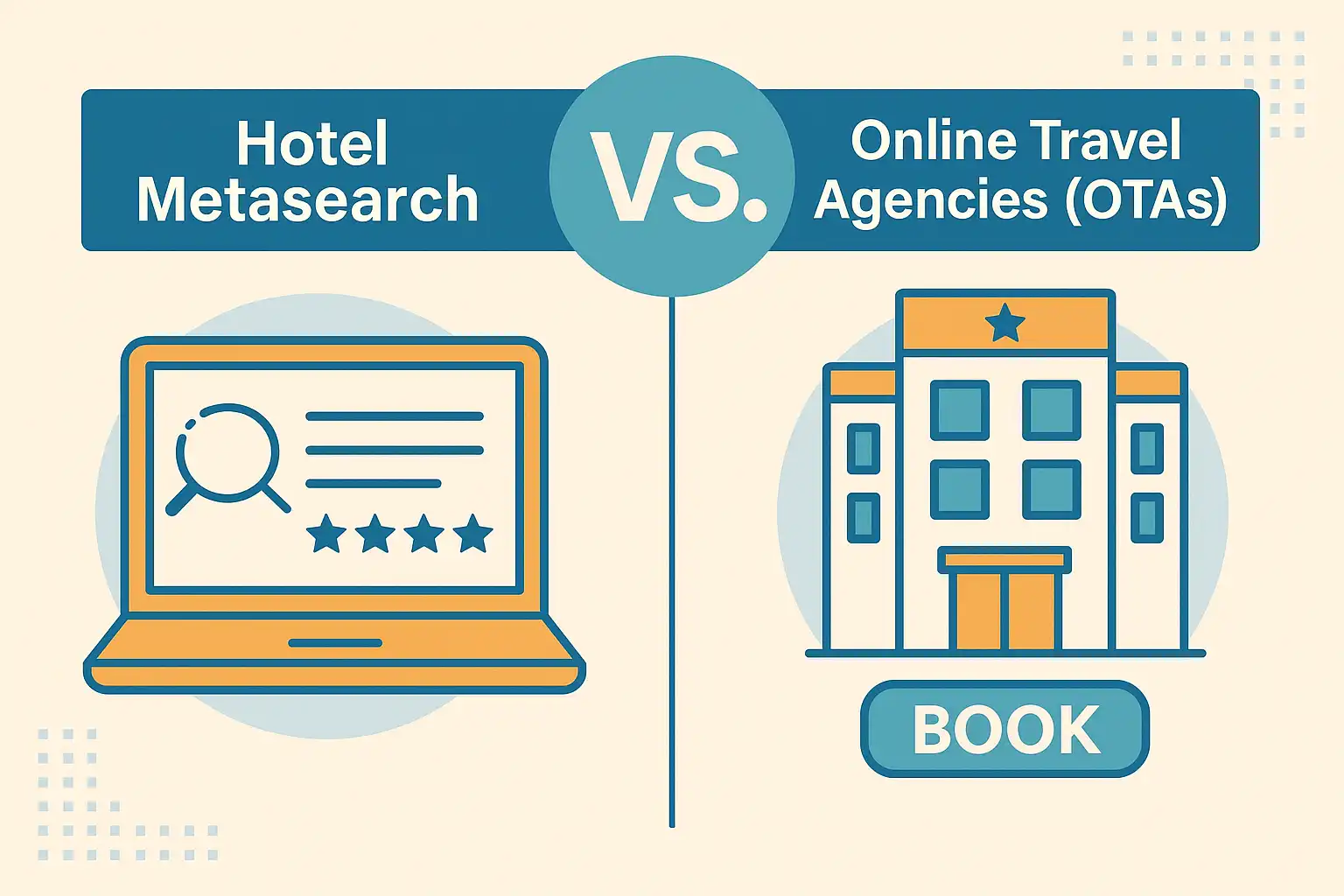

Hotel Metasearch vs. Online Travel Agencies (OTAs): What’s the Difference?

Knowing how metasearch platforms differ from OTAs is key to building a smart distribution strategy. OTAs like Booking.com sell rooms directly and charge hotels a commission, while metasearch platforms simply aggregate multiple booking options but don’t handle the booking themselves.

Here’s a quick look at how they compare:

| Feature | Metasearch Engines | Online Travel Agencies |

|---|---|---|

| Booking Process | Redirect to hotel website or OTA | Complete transaction on platform |

| Payment Model | Cost per click or commission | Fixed commission rate |

| Customer Data | Shared or hotel-owned | OTA-owned |

| Rate Control | High (direct bookings) | Limited |

| Commission Costs | Variable CPC | 15-25% fixed |

This difference really impacts how hotels connect with guests. OTAs own the entire booking process and keep the guest’s contact info, while metasearch engines send users to the hotel’s website or OTA to finish booking—giving hotels a chance to build direct relationships when the booking happens on their own site.

One more thing: keeping your rates consistent across all booking channels (rate parity) is super important for metasearch success. Since these platforms show prices from many sources side-by-side, inconsistent rates can confuse guests and push them to competitors with clearer pricing.

The Top Hotel Metasearch Platforms You Should Know

Google Hotel Ads

Google Hotel Ads is the big player here, controlling 67% of metasearch spending. It’s seamlessly integrated with Google Search, Google Maps, and Google Assistant, so your hotel can pop up in regular search results, map searches, and even voice queries—giving you unbeatable visibility.

Google recently shifted away from commission-based bidding, now focusing fully on CPC models. This means hotels need to rethink their bidding and budgets to keep their spots on top.

Connecting your hotel to Google Hotel Ads doesn’t just boost your presence in search—it also helps you show up on Google Maps and Google My Business listings. Hotels linked to this platform often see around a 16% boost in direct bookings.

Plus, Google’s machine learning tools can automate your bidding to hit goals like maximizing conversions or targeting specific returns on ad spend, making campaign management a bit easier.

TripAdvisor

TripAdvisor mixes metasearch with tons of user reviews and travel content, creating a unique space where managing your online reputation goes hand-in-hand with advertising.

They offer advertising options like the TripConnect CPC model, Instant Booking (commission-based), and Sponsored Placements. Most hotels lean toward CPC because Instant Booking doesn’t convert as well and often sends users elsewhere anyway.

TripAdvisor is more than just a booking platform—it’s a key tool for reputation management. Hotels need to keep an eye on reviews and respond actively while optimizing their ads to get the best ROI.

Hotels tend to use TripAdvisor more for brand awareness and reputation than for direct bookings, making it a valuable part of a well-rounded digital marketing plan.

Trivago

Trivago has a global reach, working with over 180 OTAs worldwide. Owned by Booking Holdings, it’s especially strong in Europe but growing in North America too.

They’ve shifted their ranking from just lowest price to also considering marketing budgets and bids. So, hotels with bigger bids and smarter campaigns can rank higher, even if they don’t have the absolute lowest rates.

Trivago offers both CPC and cost-per-acquisition bidding, giving hotels flexibility depending on their marketing goals.

It’s especially effective in German-speaking markets and other parts of Europe, so think about your target audience when budgeting here.

KAYAK

KAYAK, also owned by Booking Holdings, runs HotelsCombined and has a solid presence across many travel categories. It supports over 60 international sites in 20+ languages, giving hotels a wide global audience.

KAYAK isn’t just about hotels—it also compares flights and car rentals, appealing to travelers planning entire trips, which can increase booking value and satisfaction.

It’s particularly strong in North America, making it a good choice if that’s your key market.

Their travel planning tools and price predictions set them apart from pure comparison sites, attracting engaged travelers more likely to book.

Emerging Platforms

There are some rising stars worth watching:

- Wego dominates Asia Pacific and MENA regions, operating in 76 countries and 22+ languages. Great for hotels focusing on these fast-growing markets.

- Skyscanner Hotels Service, launched in 2014, serves 100 million users monthly across 52 markets. It’s strong in flight search, which naturally complements hotel bookings, especially for international travelers.

- Hopper uses smart price forecasting algorithms and expanded into hotels in 2017 and vacation rentals in 2022. It’s perfect for price-conscious travelers hunting for the best deal at the right time.

- HotelsCombined aggregates over 2 million hotel deals worldwide in 220+ countries and 42 languages, ideal for hotels seeking broad international exposure.

Why Hotel Metasearch Marketing Is a Game-Changer

Drive More Direct Bookings

The biggest perk of metasearch marketing? More direct bookings without paying the hefty 15-25% OTA commissions that eat into your profits. When travelers click through from metasearch sites to your website and book directly, you keep all the revenue and start building a direct relationship with your guest.

Owning that guest relationship means you can collect contact info for future marketing, loyalty programs, and personalized offers that keep guests coming back.

You also get to upsell—think room upgrades, spa packages, dining deals—that boost your average revenue per guest.

Plus, being visible alongside OTAs but offering exclusive direct booking perks gives you a serious edge.

Get Seen by More Travelers

Metasearch platforms pull in millions of searches from travelers actively comparing hotels. This exposure helps independent hotels compete with big chains by reaching audiences they might never find otherwise.

Users on metasearch sites are usually ready to book within 24-48 hours, so the traffic you get is high intent—meaning better conversion rates than general digital ads.

You can also target specific markets geographically, focusing your ad spend where it’s most likely to pay off.

Even if some travelers don’t book right away, metasearch helps build brand awareness that can lead to future bookings or referrals.

Marketing That Makes Sense for Your Budget

With CPC pricing, you only pay when someone clicks through to your site—no wasted impressions. You can set daily budgets and max bids to keep costs under control and adjust in real-time based on demand.

Detailed reporting lets you track clicks, bookings, and revenue so you can optimize your campaigns and get the best bang for your buck.

Compared to traditional digital marketing, metasearch often delivers lower acquisition costs and higher conversion rates thanks to its travel-focused audience.

Bidding and Payment Models in Hotel Metasearch

Cost-Per-Click (CPC)

With CPC, you pay for every click regardless of whether it turns into a booking. This gives you control over your budget and lets you focus on attracting quality clicks that convert.

Bids typically range from $0.50 to $5.00 depending on competition, season, and location. Big cities and peak travel times usually cost more, while smaller markets and off-season are cheaper.

The key is balancing bid amounts to get good ad placement without overspending. Monitoring your cost per acquisition helps keep things profitable.

Commission-Based Models

Some platforms still offer commission models, charging a percentage of the booking value only when a booking completes. Rates usually run 8-15%, lower than OTAs but still a cost to consider.

Google is phasing out commission models by 2025, pushing hotels toward CPC.

Commission models shift risk to the platform but can cost you even if guests cancel, so factor that into your calculations.

Hybrid and New Models

Cost-per-acquisition (CPA) models charge only for completed bookings but keep transparent pricing.

Google’s Performance Max campaigns use machine learning to automate bidding across Google’s properties, including Search, Maps, and YouTube, making campaign management easier.

Target ROAS (Return on Ad Spend) bidding lets you set revenue goals and lets algorithms optimize your bids to hit those targets.

Some platforms offer flexible billing options like monthly invoices or prepaid credits to suit your cash flow.

What You Need to Succeed in Hotel Metasearch

Solid Tech Setup

A dependable property management system (PMS) is your foundation. It helps manage rates, availability, and inventory across all your booking channels, ensuring real-time, accurate data that prevents overbookings and keeps your rates consistent.

Using a channel manager is a lifesaver if you’re on multiple metasearch platforms. It syncs your rates and availability automatically, cutting down on manual work and the risk of double bookings.

Your booking engine should offer a seamless, direct booking experience with real-time inventory and secure payment processing. Mobile optimization is a must since over 70% of last-minute bookings happen on smartphones.

For larger hotels, a reliable PMS or central reservation system (CRS) is vital for advanced distribution and revenue management.

Make Your Listings Shine

Great photos are non-negotiable—aim for 10-15 professional shots showing your rooms, amenities, and property exterior. Visuals directly impact click-throughs and bookings.

Keep your property info accurate and complete—detailed descriptions, amenities, policies, and contact info build trust and reduce booking abandonment.

Maintain rate parity across all channels to avoid confusing guests and penalties from metasearch platforms.

Don’t forget review management! Monitor and respond to guest feedback across platforms to boost your listing quality and influence traveler decisions.

Best Practices and Winning Strategies

Choose the Right Platforms and Budget Wisely

Focus on metasearch engines popular with your target audience and markets. Different platforms perform better in different regions, so tailor your approach instead of going broad.

Typically, 40-50% of your budget should go to Google Hotel Ads, 20-30% to TripAdvisor for visibility and reputation, and the rest spread across other platforms based on performance.

Track cost-per-acquisition and return on ad spend regularly to shift budget toward the best performers.

Adjust your budget seasonally—spend more during peak times and scale back when demand is low for better ROI.

Smart Rate Strategies

Keep rates consistent across channels to avoid penalties and confusion.

Offer value-added packages with perks like breakfast, WiFi, or parking to stand out beyond just price.

Use dynamic pricing based on demand, competitor rates, and booking pace to maximize revenue.

Promote special offers and last-minute deals to attract price-sensitive guests and fill empty rooms during slower periods.

Optimize Campaigns

Target your ad spend geographically to focus on markets with the best booking conversion and guest value.

Adjust bids for mobile versus desktop users since booking behaviors differ.

Tailor bids based on booking timing—last-minute versus advance bookings—to capture different traveler mindsets.

Change bidding strategies seasonally to match demand and revenue goals.

How to Measure Your Success

Key Metrics to Track

- Click-through rate (CTR): Aim for 2-8% depending on platform and market.

- Conversion rate: Target 3-12% of clicks turning into bookings.

- Cost per acquisition (CPA): Calculate total cost per booking, including non-converting clicks.

- Return on ad spend (ROAS): Shoot for at least 3:1 revenue to ad spend ratio.

Advanced Insights

Use attribution modeling to track the full guest journey from click to booking, revealing how metasearch contributes to your sales.

Analyze lifetime value to see repeat bookings and total revenue from metasearch guests, justifying your marketing spend.

Keep an eye on competitors’ rates and promotions to stay competitive.

Coordinate metasearch bidding with overall revenue management to keep your pricing strategy consistent.

The hotel industry is evolving fast, and metasearch engines are becoming central to how travelers find and book rooms. Success means thinking strategically, mastering the tech, and continuously optimizing your campaigns to get the most out of these powerful tools.

Savvy hotels know that metasearch marketing isn’t just about quick bookings—it’s about building lasting advantages through better visibility, direct guest relationships, and less reliance on costly OTAs. Those who master these platforms will capture more market share and boost profitability.

Start your metasearch journey today—begin with Google Hotel Ads for the widest reach, then expand to other platforms based on your market and results. The future of hotel distribution belongs to those who use metasearch marketing smartly and effectively.