Bed and Breakfast vs Hotel: Are There Real Differences?

Sep 19, 2025

Mika Takahashi

Mika TakahashiPopular Categories

Hotel Technology & InnovationHotel Operations OptimizationDigital MarketingIndustry TrendsRevenue ManagementHospitality Industry

Popular Categories

Trending Post

Hotel Walk Letter Template: Professional Guest Communication

Online Travel Agents: What They Are and How They Work

Hotel Security Systems: Modern Protection Solutions

Hotel Advertising: Complete Guide to Boost Bookings and Revenue

25 Hotel Marketing Strategy Ideas for 2025: Complete Guide

AI Reservation Agent: Revolutionizing Hotel Booking and Guest Experience

PMS Communication: Streamlining Property Management Through Effective Guest Messaging

Table of contents

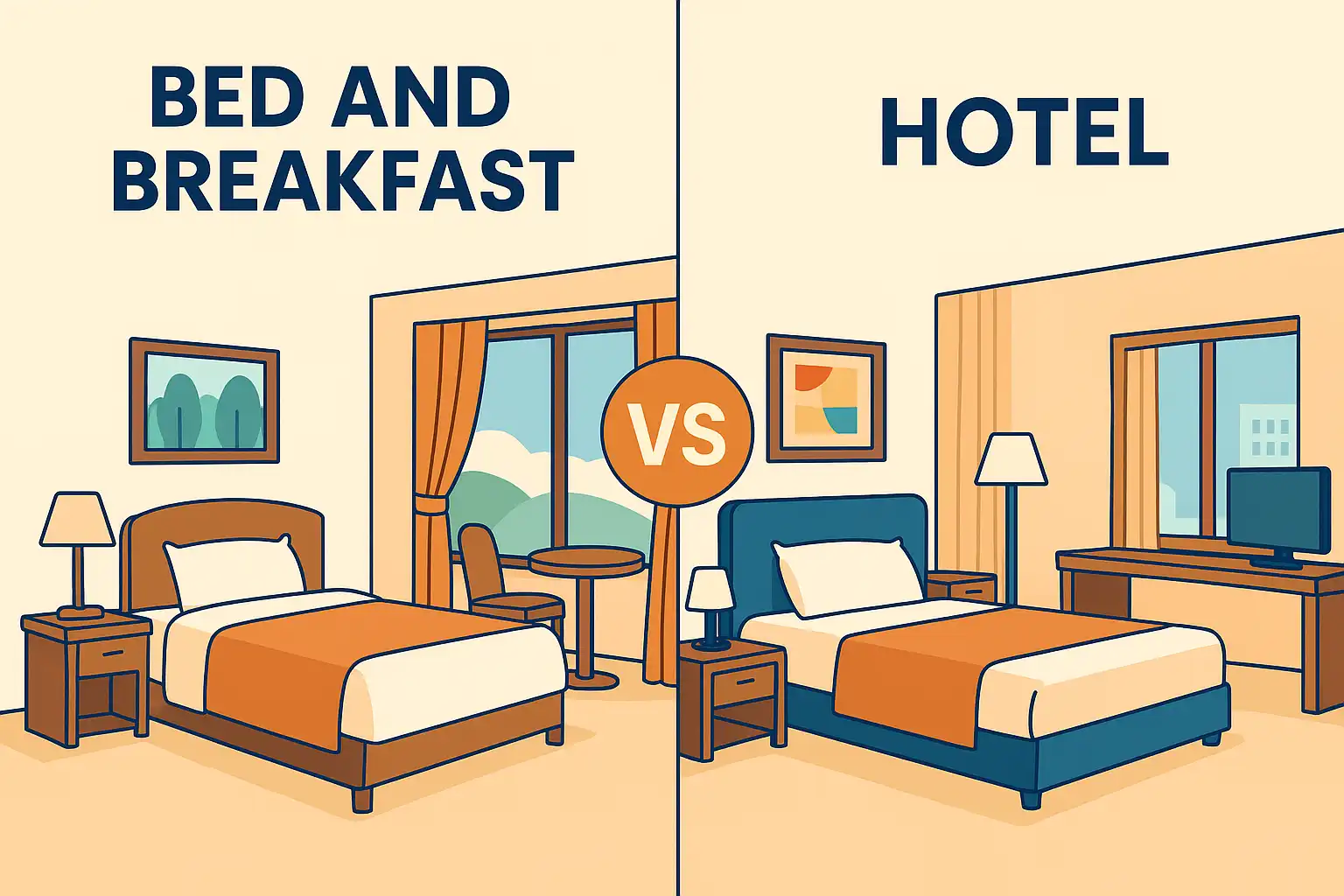

The global bed and breakfast market is booming, projected to hit $22.9 billion by 2026 with a steady growth rate of about 7% annually. For anyone in the hospitality business, understanding the bed and breakfast vs hotel dynamic isn’t just about sizing up the competition—it’s about spotting smart opportunities, streamlining operations, and tuning into the right market segments to help your property shine and grow.

This deep dive breaks down the main differences between bed and breakfasts and hotels from an operational standpoint. It’s packed with practical insights for hotel owners, managers, and hospitality pros who want to sharpen their competitive edge in today’s fast-changing market.

Key Operational Differences Between B&Bs and Hotels

When we talk about bed and breakfast vs hotel, the differences go way beyond just how many guests each can host. Getting a handle on these operational contrasts is crucial for hoteliers looking to carve out their niche and boost their strengths.

Size and Scale Dynamics

Most bed and breakfasts run with a cozy 4-11 rooms, averaging around six rooms globally. Hotels, on the other hand, tend to be much larger—think 50 to 500+ rooms for many commercial properties. This size gap shapes everything from staffing needs to revenue potential.

For hoteliers, this means both challenges and chances. While big hotels can’t replicate the intimate vibe that defines many bed and breakfasts, boutique hotels with 20-40 rooms might just capture some of that B&B charm, all while offering hotel-style amenities and consistent service.

Staffing Models and Labor Structure

One of the biggest operational differences in the bed and breakfast vs hotel debate is staffing. B&Bs often lean on owner-operators who live on-site, handling everything from welcoming guests to serving that famous home cooked breakfast each morning. This personal touch is a big draw for travelers craving local insights and genuine connections.

Hotels, meanwhile, run with specialized teams—front desk staff, housekeeping, food and beverage pros, maintenance crews—all working around the clock. This setup guarantees 24/7 service and steady quality but can sometimes feel less personal than the warm, homey feel of a bed and breakfast.

Service Delivery Approaches

When it comes to service, bed and breakfasts focus on family-style, personalized care. Breakfast owners often whip up meals tailored to special diets, share insider local recommendations, and tweak services to fit guest preferences. This flexibility creates unforgettable stays but can be tricky to scale.

Hotels prioritize standardized service to keep things consistent across shifts and locations. While this means you can expect reliable quality, it doesn’t always capture the unique local flavor that many B&Bs offer, often nestled in charming residential neighborhoods.

Revenue Stream Configuration

Revenue-wise, bed and breakfasts mostly rely on room charges that include amenities like free breakfast, Wi-Fi, and sometimes parking. This all-in-one pricing keeps things simple for guests but limits extra revenue streams.

Hotels, however, juggle multiple income sources—rooms, food and beverage, events, spas, parking fees—you name it. This diversity boosts profitability but comes with more complex management and higher costs.

Target Market and Guest Expectations

Knowing who chooses bed and breakfasts versus hotels—and why—helps hoteliers spot gaps and tailor their offerings.

Guest Motivation and Experience Preferences

Guests at bed and breakfasts usually seek authentic local experiences, romantic settings, and meaningful host connections. They value character over convenience, choosing places with individually decorated rooms and a strong sense of local culture. Stays tend to be longer here—2-3 nights—perfect for weekend escapes or vacations.

Hotel guests often prioritize convenience, reliability, and professional amenities. Business travelers want quick check-ins, solid Wi-Fi, room service, and modern comforts. Leisure travelers look for prime locations, consistent rooms, and access to facilities like gyms and pools.

Demographic and Psychographic Profiles

B&B visitors are typically aged 35-65, often couples with disposable income and flexible schedules. They love discovering hidden gems and unique experiences, making last-minute planning less common. They appreciate a perfect place for a romantic setting and hosts who know the local scene inside out.

Hotel guests cover a broader spectrum—business folks, families, groups—often booking multiple rooms. Location near business hubs or attractions is key, and they tend to shop around across booking platforms before deciding.

Length of Stay Patterns and Booking Behavior

Bed and breakfasts usually enjoy longer guest stays (2-3 nights) compared to hotels (1.5-2 nights), reflecting their appeal for immersive experiences over quick stops. Many B&Bs require minimum stays on weekends or peak times, especially for romantic getaways.

This longer stay means higher revenue per guest but often lower occupancy rates overall. Hoteliers can learn from these patterns to craft smart packages and set minimum stays during busy periods.

Technology and Systems Requirements

Tech needs vary a lot between bed and breakfasts and hotels, shaping how each operates and competes.

Property Management System Needs

Hotels need robust Property Management Systems (PMS) to juggle complex tasks like room inventory, rate optimization, guest billing, group bookings, and syncing with multiple sales channels. For properties with more than 20 rooms, a PMS is essential to avoid errors and inefficiencies.

Most bed and breakfasts get by with simpler booking tools or even manual systems. While this keeps costs low, it limits advanced revenue management and distribution reach. Still, some B&Bs are adopting cloud-based PMS designed for smaller venues to boost efficiency.

Integration and Distribution Requirements

Hotels rely on tight integration between PMS, Central Reservation Systems (CRS), Point of Sale (POS) systems, and Online Travel Agencies (OTAs). This ensures real-time inventory updates, automated pricing, and a smooth guest journey across platforms.

Bed and breakfasts tend to focus on direct bookings through their websites, local tourism boards, and select OTAs. This approach yields higher profits per booking but can restrict market reach compared to hotels’ broad distribution.

Investment Considerations for Hotel Technology

For hotels over 20 rooms, investing in PMS usually pays off within 12-18 months by streamlining operations and boosting revenue. Key points include:

- Initial PMS costs: $3,000–15,000 for mid-market properties

- OTA integration: $5,000–25,000 depending on complexity

- Annual maintenance: 15-20% of initial investment

- Revenue management tools can lift average daily rates by 5-15%

- Staff training averages 20-40 hours per front desk employee

- Full system adoption typically takes 60-90 days

- Ongoing training needed for updates and new hires

- Tech-enabled upselling can increase ancillary revenue by 10-25%

Service Standards and Quality Control

Service and quality approaches highlight core differences in the bed and breakfast vs hotel experience, each with its perks.

Brand Consistency vs Unique Character

Hotel chains bank on brand consistency so guests know what to expect no matter where they stay. This covers room layouts, amenities, service routines, and dining options. While it builds loyalty and smooth operations, it can feel a bit impersonal.

Bed and breakfasts shine by showcasing unique character. Each property tells a story through its décor, history, and personal touches from owners. This authenticity appeals to travelers craving something different from cookie-cutter hotels.

Staff Training Protocols

Hotels invest heavily in formal hospitality training, teaching staff scripts, procedures, and brand standards to ensure consistent service quality across shifts.

B&B owners usually rely on their own hosting skills and local knowledge. This can lead to warm, genuine interactions but sometimes means service depends on the owner's mood and availability.

Quality Assurance Programs

Hotels run systematic quality checks—regular inspections, guest feedback analysis, mystery shoppers—to keep standards high.

Bed and breakfasts depend more on owner oversight and direct guest feedback, allowing quick fixes and personalized adjustments, though lacking formalized quality control systems.

Revenue Management and Pricing Strategies

Pricing and revenue management also differ widely between bed and breakfasts and hotels.

Dynamic Pricing vs Seasonal Adjustments

Hotels often use dynamic pricing, adjusting rates multiple times daily based on demand, competition, and market trends. This maximizes revenue but requires sophisticated systems.

Bed and breakfasts usually stick to seasonal pricing, keeping rates steady for weeks or months. This simplicity appeals to guests who prefer transparent, predictable costs.

Average Daily Rate Performance

Hotel average daily rates (ADR) range widely from $150 to $300 depending on location and brand.

B&Bs typically charge $120 to $250 per night, often including breakfast and amenities that hotels charge for separately. Considering these inclusions, B&Bs can offer better value in many markets.

Ancillary Revenue Opportunities

Hotels make significant extra income from food and beverage, spas, events, parking, and resort fees—sometimes 25-40% of total revenue.

Bed and breakfasts have fewer ancillary revenue streams, though some offer local experiences or retail products on the side.

Length of Stay Requirements and Weekend Premiums

Many B&Bs require minimum stays—often two nights on weekends or during peak seasons, especially for romantic getaways.

Hotels usually avoid minimums except for big city events, preferring flexible bookings to maximize occupancy.

Marketing and Distribution Strategies

Marketing tactics reflect the different needs and strengths of bed and breakfasts versus hotels.

Hotel Marketing Infrastructure

Hotels use broad strategies—loyalty programs, corporate contracts, OTA partnerships, global reservation systems, and big ad campaigns. Customer acquisition costs run 15-25% of revenue but open access to diverse markets.

B&B Marketing Focus

Bed and breakfasts emphasize direct bookings, local tourism partnerships, and romantic getaway packages. Their marketing highlights uniqueness, local culture, and personal service. Acquisition costs tend to be lower (8-15%), relying heavily on word-of-mouth but with narrower reach.

Digital Presence Requirements

Hotels invest in sophisticated, mobile-optimized websites with booking engines and rich content.

B&Bs often thrive with simpler sites showcasing photos, local attractions, and personal stories. Social media marketing focuses on platforms like Instagram and Facebook to highlight their intimate vibe.

Competitive Positioning for Hotels

Hotels can highlight:

- Consistency and reliability with standardized service and 24-hour availability

- Business-friendly features like meeting rooms, fitness centers, and loyalty perks

- Global brand recognition and easy booking for travelers seeking familiarity

Operational Efficiency and Scalability

The operational setups of bed and breakfasts vs hotels create unique advantages and limits for growth.

Housekeeping Operations

Hotels rely on teams using standardized processes and equipment to clean many rooms efficiently.

B&Bs often see owners personally handling housekeeping, which adds care but limits scalability and owner availability.

Food Service Management

Hotels have professional kitchens and staff to serve large numbers with standardized menus and room service.

Bed and breakfasts offer home cooked breakfasts made by owners, creating a cozy, personalized dining experience but limiting guest capacity.

Maintenance and Facility Management

Hotels need dedicated maintenance teams or contracts to manage complex systems and high guest turnover.

B&Bs rely more on owners’ hands-on care, which can be great for quick fixes but depends on owner skills and presence.

Growth Potential and Scalability

Hotels can grow through franchises and multi-property ownership with standardized systems.

B&Bs face limits due to personal owner involvement. Some manage multiple properties, but growth often means hiring managers to keep the personal touch alive.

Financial Performance Metrics

Understanding financial differences helps in planning and positioning.

REVPAR and Occupancy Analysis

Hotels usually have higher revenue per available room (REVPAR) thanks to higher occupancy (65-75%).

B&Bs have lower occupancy (40-60%) but often charge premium rates and enjoy longer stays.

Operating Expense Ratios

Hotels spend 65-75% of revenue on operations due to staffing and amenities.

B&Bs operate leaner (45-60%), benefiting from owner labor and simpler costs, leading to higher profit margins despite smaller scale.

Profit Margins and ROI

B&Bs often enjoy better profit margins thanks to lower labor and complexity but have limited absolute profits.

Hotels generate larger total profits through volume and diversified income.

Capital Investment Requirements

Hotels require hefty investments—$100,000 to $300,000 per room—demanding professional management.

B&B conversions cost less—$25,000 to $75,000 per room—making them accessible to smaller investors but limiting expansion.

This detailed bed and breakfast vs hotel analysis highlights two very different hospitality models, each serving unique guest needs and market niches. For hoteliers, blending the personal, local charm of B&Bs with the efficiency and scale of hotels could be the key to standing out.

Hotels excel at scalability, professional amenities, and consistent service, while bed and breakfasts offer personalized service, authentic local experiences, and intimate settings that many travelers crave.

The future belongs to those who understand how to balance these strengths—offering guests both reliable comfort and memorable, personal touches.

So, where does your property fit in the bed and breakfast vs hotel spectrum? Are there ways to add more personal touches without losing efficiency? Can you tap deeper into local culture to make your property a great choice for travelers seeking something special? Use these insights to sharpen your strategy and capture the best of both worlds in the evolving hospitality landscape.