Service Charge vs Tip: What Are The Differences

Mika Takahashi

Mika Takahashi Mika Takahashi

Mika TakahashiA service charge is a fee that hotels and other hospitality organizations have to add to a customer's bill. A tip, on the other hand, is a payment that clients give directly to service staff. This basic difference between a service charge and a tip has an impact on everything from paying taxes to paying workers and making guests happy in both the restaurant and hotel industries.

This article is all about service charges and tips for hotels, resorts, vacation rentals, and other hospitality businesses. When managing visitor payments, hotel managers, property owners, and hospitality operators need to know about the legal, operational, and financial effects. It's important to know the fundamental difference between these types of payments because misclassifying them can cause problems with the tax department, influence your payroll obligations, and make both guests and employees unhappy.

Service charges are required fees that your property collects and uses to pay for company expenses and wages. Tips, on the other hand, are optional donations that go directly to the service staff as their property. Service charges let you decide how to use the money, but they have different tax rules than gratuities.

The difference between a charge and a tip is a big part of how hotels handle money, pay their workers, and talk to clients. Getting this correctly will help your bottom line, keep your team's pay steady, and make sure you follow federal and state laws.

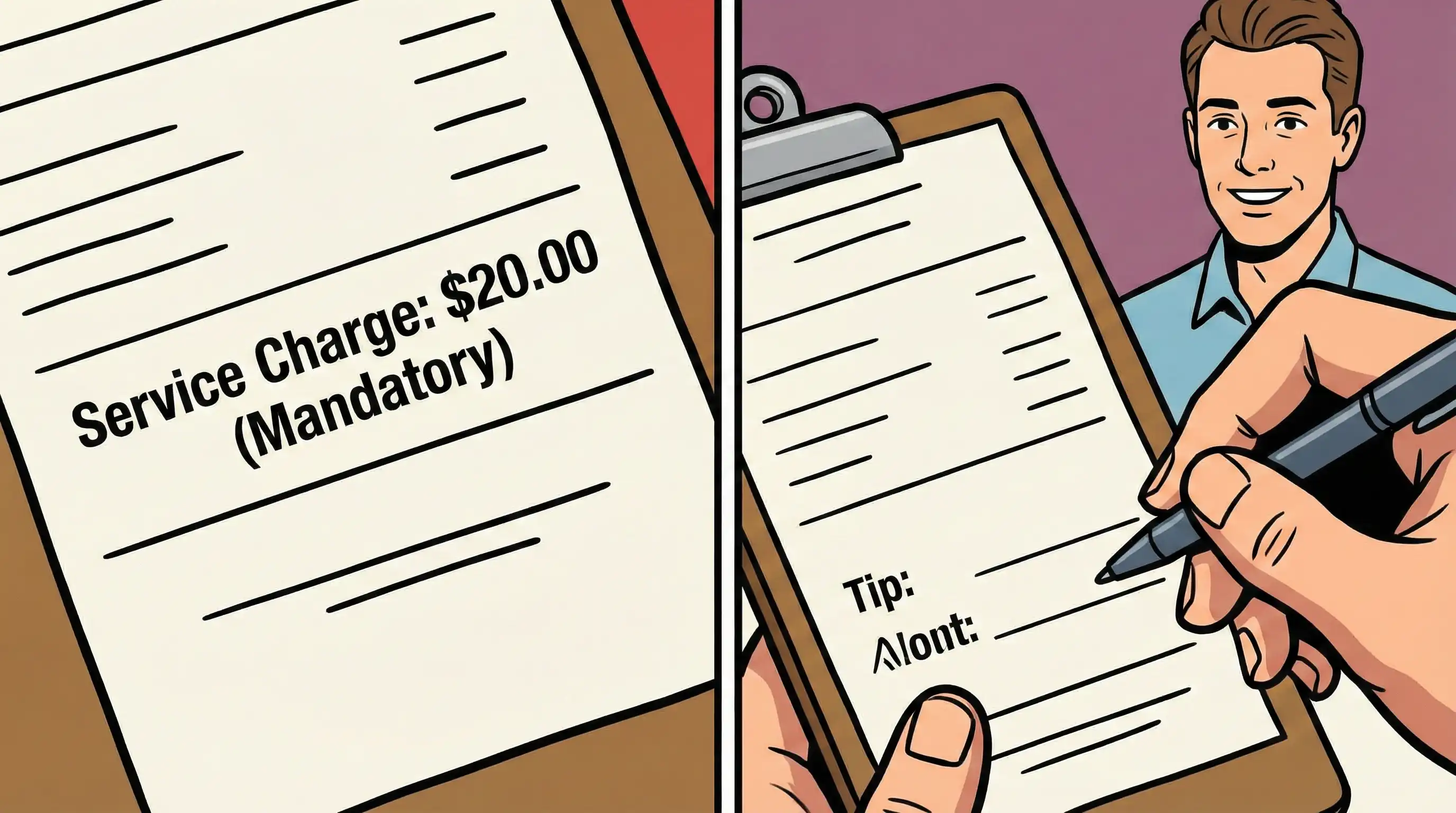

Hotels automatically add a service charge to a guest's total bill. This charge is usually between 15% and 25%. The customer can't bargain or refuse to pay this price, which is what makes it different from a tip in the eyes of the law.

In the hospitality industry, resort fees cover amenities, banquet event fees cover group gatherings, spa service charges cover room service, and bottle service charges cover drinks at hotel bars. Many hotel restaurants also include automatic tips for groups of eight or more people.

These costs go straight to the hotel's bottom line because service charges are considered company income. This money helps restaurant and hotel owners pay for rising expenditures including labor, amenities, facilities upkeep, and operating costs, which have gone up a lot in the last few years.

Guests can choose to give tips to service workers based on how well the food or service was. The consumer has the freedom to choose both the amount and the receiver without any restrictions.

You might leave a tip for housekeeping (usually left in the room every day), concierge services for extra help, bellhops for carrying your bags, and restaurant personnel for serving meals and drinks. These payments are based on the guest's choice and pleasure with the service, not on a set pricing structure.

There is a clear link between gratuities and the quality of service. For example, front-of-house staff and tipped employees generally make more money when they give great service. But this also means that restaurant and hotel workers' incomes can change, which can make it hard for them to stay financially stable and happy at work.

It is important to know why these legal differences matter for hotel operations since the tax department treats these payment methods quite differently, which has big effects on your business.

Based on these standards, hotels have to follow certain rules for payroll, reporting, and distribution practices.

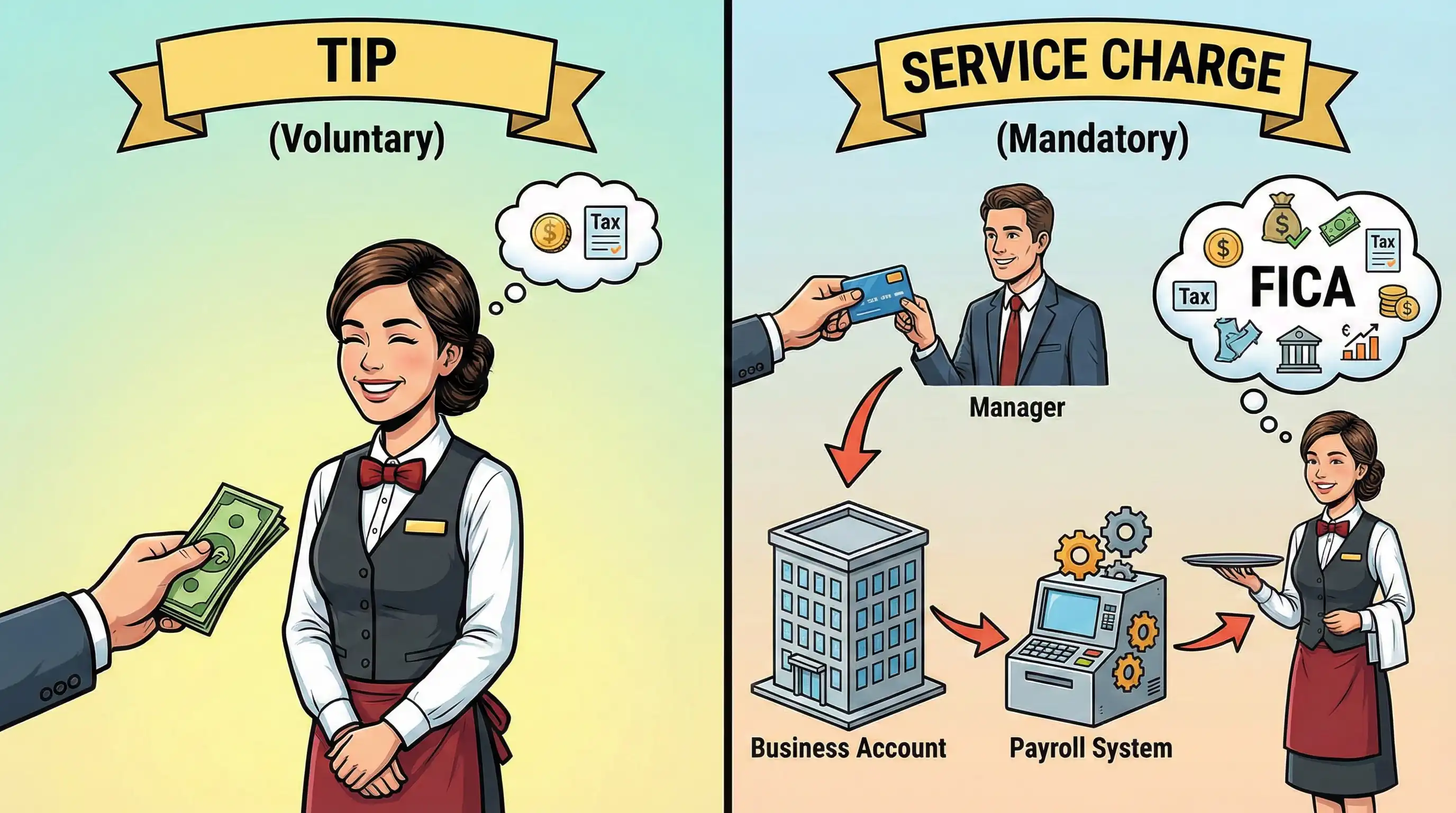

The IRS says that service charges are company income that most states must collect sales tax on. When you provide staff parts of service charges, those payments become non-tip earnings that need to have the same payroll taxes taken out as regular wages, like Social Security and Medicare taxes.

Tips are taxed in a different way. When cash tips add up to $20 or more in a month, employees must tell their employer. These amounts are shown on Form W-2 in separate sections for wages, Medicare tips, and Social Security tips. Tips, on the other hand, are not considered business income, thus they don't have to pay sales tax.

It's important to note that service charges and automated gratuity amounts do not contribute toward the tip credit that employers might use to lower their minimum wage requirements. The federal minimum wage for tipped workers is $2.13 per hour, however this only applies when tips, not service charges, bring the total pay up to at least the standard minimum wage of $7.25 per hour.

The way service charges and tips are taxed in Europe is very different from how they are taxed in the United States. Most of the time, service charges added to a customer's bill are considered part of the restaurant or hotel's income and are subject to normal corporate tax and value-added tax (VAT) rules. Depending on the country's labor rules, these charges may also be liable to payroll taxes when they are given to employees.

But in Europe, tips are often handled differently from one country to the next. When you offer tips directly to service staff, they are often considered personal income and may be taxed. However, certain nations have rules that make it easier to disclose small sums. In many European countries, it's not as common to tip as it is in the U.S. because the cost of service is generally included in the menu pricing or the bill.

It is very important for hospitality firms in Europe to know the rules around service charges and tips so that they can follow them and report them correctly. To avoid confusion and keep visitors' trust, it's also important to be clear with them about how service costs are used and shared.

Because of different tax laws and cultural norms, the way service charges and tips are taxed in Asia varies a lot from country to country. In a lot of Asian nations, service charges that are added to a customer's bill are seen as part of the business's income and are subject to any sales or goods and services taxes that apply. In places like Singapore and Hong Kong, service charges are usually taxed with either the Goods and Services Tax (GST) or the Value-Added Tax (VAT).

Many Asian cultures, on the other hand, don't generally give or demand tips, and when they do, they are often seen as personal presents rather than taxable revenue. In some places, like Japan and South Korea, it's not common to tip and they could even refuse it. If you do tip, the tax effects depend on the labor and income tax rules in your area.

To stay in compliance and keep good relationships with guests, hospitality organizations in Asia should learn about the different tax laws and cultural norms for service charges and tips in each nation. It's also crucial to be clear about any required service prices so that overseas guests don't become confused and trust you.

Hotels have full control over how service charges are split up. You can keep all of the service charges to pay for administrative costs and running costs, or you can give some of them to employees as bonuses, higher compensation, or better perks. Most hotels and restaurants that collect service fees do it through payroll instead of direct payments.

On the other hand, tips are only for the people who get them. Hotels can't keep any of the tips for business purposes, but they can set up tip pools where all the tips are gathered and fairly divided among the service crew. Customers need to know about any rules on tip pools.

This difference has a big impact on how staff are paid. Service charges make it easier to estimate income, but they also mean more work for payroll. Tips, on the other hand, give immediate rewards for good service but make income less stable.

Hotels must clearly list mandatory service fees on their websites, booking confirmations, and final bills. To avoid guest complaints and possible legal problems, reservations must be clear about the different costs that are imposed.

Requirements that are different in each state make things more complicated. For example, in Massachusetts, service charges can only be used instead of tips, and the money goes to the employees who would normally get tips. If you charge extra fees for things like paperwork that aren't part of the service charge, you need to make it clear that these fees are not tips and won't go to personnel.

Classification, control, and openness are the most important legal differences that affect how hotels run. If you get any of these wrong, you risk breaking the law and making guests unhappy.

Once the legal framework is in place, hotels can plan how to put it into action in a way that gets the most benefits and the fewest problems.

When your property wants to cover escalating expenditures, give service workers more stable pay, or make billing easier for banquet events and group functions, think about adding service charges. A lot of hotels and restaurants have switched to service fee models so that employees can get paid fairly no matter how much they tip.

To make sure it works, do these things:

| Factor | Service Charge Model | Traditional Tipping |

|---|---|---|

| Staff Income Predictability | High — consistent wages regardless of individual guest behavior | Low — varies by shift, season, and guest discretion |

| Guest Experience | Set clear expectations upfront; some guests prefer simplicity | Familiar model; allows guests to reward good service directly |

| Administrative Burden | Higher — requires payroll processing and tax withholding | Lower — tips go directly to employees with minimal employer involvement |

| Legal Compliance | Complex — must follow wage laws, overtime calculations, distribution rules | Simpler — primarily tip reporting and credit requirements |

| Revenue Impact | Provides predictable revenue stream for cost coverage | No direct business revenue from guest payments |

| Operational Complexity | Requires system configuration and ongoing management | Minimal systems needed beyond tip reporting |

Your property type, the types of guests you get, and your operational priorities will all affect the best way to do things. Service charges are typically helpful for full-service hotels that host banquets, although boutique hotels may prefer conventional tips to keep their guest interactions personal.

Hotels that use or manage service charge vs. tip policies often run into the same problems over and over again, which need to be solved ahead of time.

People who stay at hotels often don't know what service charges are for or if they replace or add to tips. This uncertainty makes people angry and leaves bad reviews.

Make sure you have a clear way to communicate with customers by being straightforward about things like booking, sending confirmation emails, and putting up signs at service points. Give your personnel particular scripts to follow, like, "Our 20% service charge includes tips for all staff who helped you with your meal." You don't have to leave a tip, but any extra money is appreciated and goes straight to your server.

Service workers who are used to getting tips may not like service fee models because they are afraid they will make less money or not get direct appreciation from guests for good service.

Make clear rules on how service charges are paid out so that everyone knows how they affect pay. Show how income benefits by comparing historical data that shows more stable earnings. Think of hybrid models where service costs add to, rather than replace, the chance to tip for great service.

Older property management systems may have trouble accurately calculating, displaying, and reporting service charges, which can cause accounting problems and compliance issues.

Put money into new hotel management systems that automatically figure out service charges and include payroll reports. These systems make sure that the same rules are used for all billing situations, that taxes are categorized correctly, and that W-2 reporting is correct for amounts that are spread out.

Technology is becoming more and more important for making compliance and operational problems that would be hard to solve easier.

The distinction between a service charge and a tip has to do with control, classification, and compliance. Service charges are required costs that you keep as business income, while tips are optional payments that only your personnel get to keep. Both are useful in hospitality, but putting them in the wrong category might lead to legal concerns and problems with operations.

Follow these steps right away to make your approach better:

Some other issues that would be interesting to look into are revenue management strategies that involve service fees, guest experience optimization that finds a balance between fee transparency and satisfaction, and staff retention tactics that use predictable pay.