Metasearch Engines in Hospitality: Guide for Hotels

Mika Takahashi

Mika Takahashi Mika Takahashi

Mika TakahashiIn today’s digital world, most travelers, about 73% check prices across multiple platforms before deciding where to book. This shift has completely changed how hotels need to think about their online presence. That’s where metasearch engines come in—these powerful platforms have changed the game for how travelers find and compare places to stay.

Unlike regular search engines that crawl the web for all kinds of information, metasearch engines in hospitality have a special role. They pull together results from multiple sources, focusing specifically on hotel rates, availability, and booking options. This means travelers get one easy-to-use interface where they can compare deals from different sites without hopping around.

The way guests research and book hotels has evolved dramatically. Nowadays, many metasearch engines play a huge role in the travel research process. For hotels, this makes these platforms essential for attracting direct bookings and cutting down reliance on expensive middlemen.

In this guide, we’ll cover everything hotels and travel businesses need to know about metasearch engines—from the big players you should know about to smart strategies to boost your visibility and revenue.

Metasearch engines in hospitality act as advanced comparison tools that gather hotel rates and availability from a variety of booking sources. Unlike a single search engine that shows general web results, these platforms zero in on travel-related data from online travel agencies (OTAs), hotel websites, and booking platforms.

At the heart of how they work is something called data fusion—a way to combine and standardize info from different sources so it’s easy to compare. When someone enters their travel details, the metasearch engine sends out queries to several other search engines and booking sites at once, then pulls everything together into one clear list.

This is quite different from OTAs. While OTAs handle bookings directly and own the transaction process, metasearch engines mainly help travelers discover and compare options. They send users to booking sites to complete their reservations and make money mostly through advertising rather than commissions.

The business model is all about connecting travelers who are ready to book with hotels and OTAs. These accommodation providers bid for spots in the search results, usually paying when a traveler clicks through to their booking page. It’s a competitive, performance-driven environment where relevance and price matter.

On the tech side, these platforms use complex ranking algorithms that weigh factors like price, user reviews, booking success rates, and advertiser bids. They pull data from different platforms and then apply their own system to figure out the best results for each search.

Research from Colorado State University shows that metasearch platforms now influence over 60% of hotel booking decisions. They’ve given travelers more power by making price comparisons transparent, while giving hotels new ways to compete directly with OTAs.

In the world of hotel metasearch, a few big names stand out. Knowing what makes each one unique can help hotels decide where to focus their efforts.

Google Travel is the heavyweight here. Integrated right into Google’s ecosystem, it shows price comparisons from over 100 booking sites. Because Google is often the first stop for travelers researching trips, hotels can get huge exposure by using Google Hotel Ads, bidding for spots when users search for hotels.

Trivago is a dedicated hotel comparison site owned by Expedia Group. It covers around 1.8 million hotels worldwide and pulls prices from more than 250 booking platforms. Trivago’s strength is its laser focus on hotel search, attracting users who come specifically to compare accommodation prices.

TripAdvisor mixes traveler reviews with price comparisons. It’s known as a trusted source for hotel research, so hotels with strong review scores can really shine here. However, maintaining those reviews is key to staying visible.

Kayak, owned by Booking Holdings, goes beyond hotels to cover flights and rental cars too. It lists over 2 million properties and combines verified guest reviews with handy price prediction tools. Kayak appeals to travelers planning entire trips, not just places to stay.

HotelsCombined offers global coverage in 200+ countries and 40+ languages. It’s known for real-time rate updates and mobile-friendly design—important since most travel searches now happen on phones.

Regional platforms also play a big role. Wego is dominant in Asia Pacific and the Middle East, including Airbnb alongside traditional hotels. Skyscanner, part of Trip.com Group, started with flights but has expanded into hotel comparisons as well.

Each platform ranks and displays results differently. Some emphasize price, others factor in user engagement, reviews, and ad bids. Hotels need to understand these differences to optimize their presence across the board.

Behind the scenes, metasearch engines rely on complex systems that gather and process data in real-time. Getting a handle on how these work can help hotels make the most of their listings.

When a traveler enters their destination, dates, and guest info, the metasearch engine sends out simultaneous queries to its connected booking sources. These might be OTA APIs, hotel booking engines, or wholesaler systems. This parallel approach ensures broad coverage without long wait times.

One of the biggest challenges is data normalization. Different sources use different names and formats for rooms, cancellation policies, and prices. For instance, one might list a “Deluxe King Room” while another calls it a “Superior King Suite” even if it’s the same room. The platform has to map all this to make fair comparisons.

Ranking is based on many signals. Price is important, but so are booking conversion rates, user reviews, and advertiser bids. Some platforms even use machine learning to tailor results based on user preferences and behavior.

When a traveler clicks a deal, the metasearch engine tracks that click and sends them to the booking site. Hotels pay based on their chosen model—usually cost-per-click or commission on bookings.

Unlike general search engines, metasearch platforms don’t crawl random web pages. They rely on structured data feeds or direct API connections to get real-time hotel info.

They also use search results clustering to group duplicate listings from different booking sites, so travelers see a clean, easy-to-navigate list of options.

Behind the scenes, systems monitor data quality and booking platform performance. If a source responds slowly, it might be left out temporarily to keep the user experience smooth. This encourages booking sites to maintain fast, reliable systems.

Joining metasearch engines offers hotels several clear advantages beyond just more eyes on their listings.

Visibility When It Counts is huge. Metasearch engines catch travelers right when they’re comparing options and ready to book. Hotels don’t have to rely on organic search or brand recognition alone—they can put their offers front and center alongside competitors.

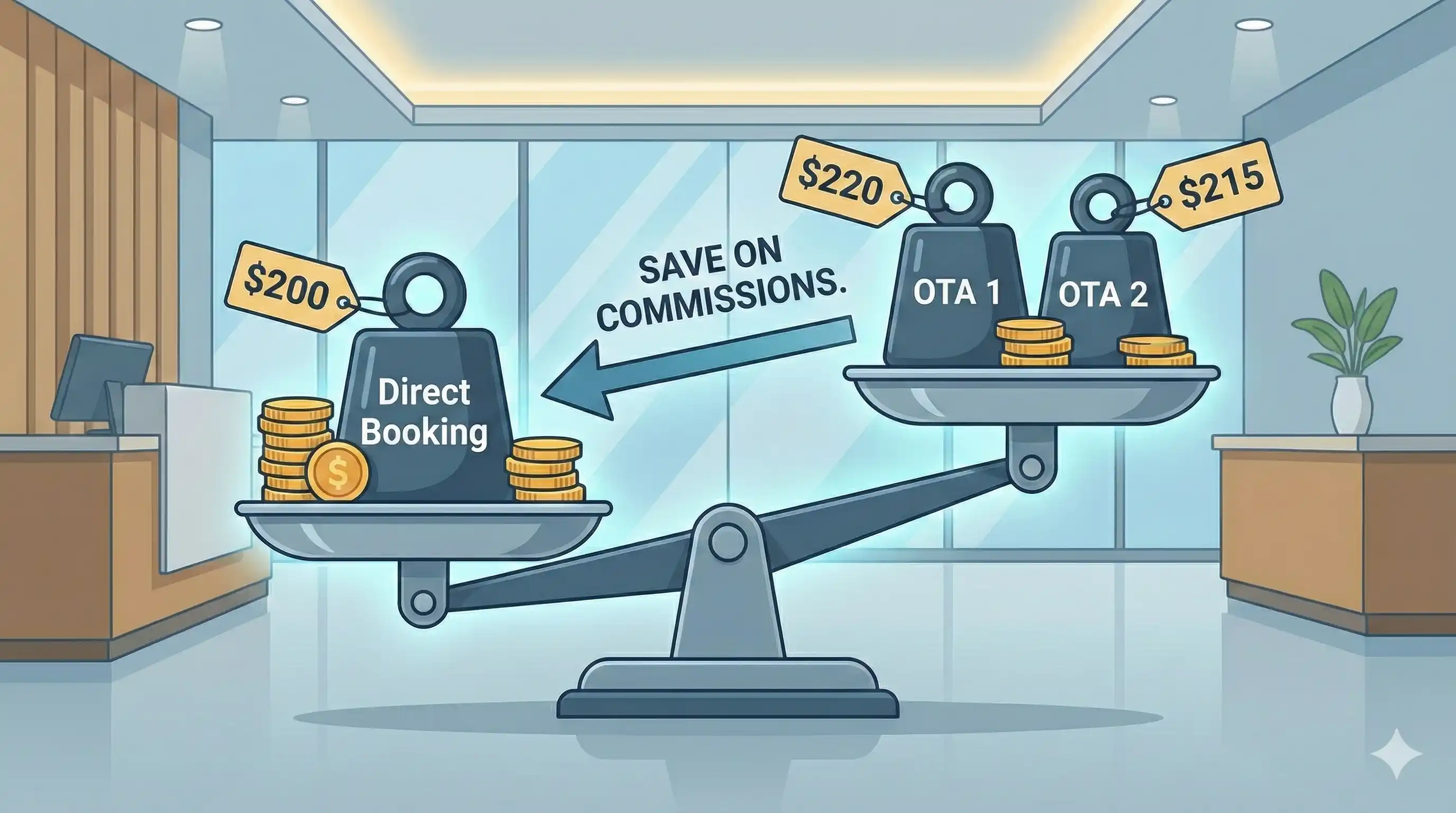

Cost-Effective Advertising is another plus. Compared to OTA commissions that can be 15-25%, metasearch platforms often charge less. Paying per click means hotels only spend when they get interested visitors, and commission models usually come with lower rates.

Competitive Insights come naturally. By participating, hotels get a clearer picture of how competitors price rooms and what amenities are popular. This helps with smarter revenue management and positioning.

More Direct Bookings become possible when hotels show their own website rates right next to OTAs. With good rate parity and perks, hotels can win bookings that might have gone to middlemen, gaining valuable guest data for future marketing.

Global Reach expands through metasearch partnerships with many OTAs and booking platforms worldwide. Instead of contracting dozens of sites individually, hotels get broad exposure through one integration.

Flexible Spending lets hotels adjust their metasearch budgets based on performance. They can ramp up during busy seasons and pull back when demand dips, making marketing spend more efficient.

Brand Defense is important too. OTAs often bid on hotel brand names in search ads, but metasearch participation ensures the hotel’s own site appears prominently to protect brand visibility.

Together, these benefits help hotels lower distribution costs while keeping or growing bookings. But it takes careful strategy and ongoing work to make the most of metasearch.

Metasearch platforms offer different ways for hotels to advertise, each with its own pros and cons.

Cost-Per-Click (CPC) is the most common. Hotels bid for visibility and pay only when someone clicks their listing. CPC rates vary widely, from around $0.50 to $3.00 per click, depending on market and season.

While bid amounts matter, platforms also consider factors like booking conversion rates and price competitiveness to decide who gets the best spots. This means hotels with strong conversion can do well even with moderate bids.

Commission-Based Models let hotels pay a percentage of completed bookings instead of upfront clicks. Rates usually range from 3-12%. This can be attractive for hotels with smaller budgets or those testing metasearch.

Hybrid Models combine CPC and commission elements. For example, Google Hotel Ads offers both options, letting hotels choose what fits best.

Managing bids well is key. Hotels need to consider demand cycles, competition, device types (mobile vs desktop), and geography to get the most from their spend.

Automated bid systems are becoming popular, adjusting prices in real-time based on occupancy, competitor bids, and conversion data.

Tracking performance is tricky because travelers often research over multiple sessions. Hotels should look beyond last-click data and consider assisted conversions to get the full picture.

Doing well on metasearch means paying attention to many details beyond just spending more on ads.

Maintaining Rate Parity is critical. If a hotel’s direct website shows higher prices than OTAs, travelers will naturally book through the cheaper option, wasting metasearch investment. Hotels need to monitor pricing closely and fix discrepancies quickly.

Rate parity issues often come from wholesalers, unauthorized sellers, or opaque inventory. Regular checks and communication with partners help close these gaps.

High-Quality Content matters too. Detailed descriptions, accurate amenities, clear policies, and great photos all boost click-through and conversions.

Review Management is increasingly important since many platforms factor ratings into rankings. Hotels with strong, fresh reviews get better visibility and more clicks. Responding to reviews professionally shows commitment to guests.

Accurate Inventory and Data keep things running smoothly. Real-time updates via APIs or channel managers prevent overbooking and outdated prices, which can frustrate users.

Conversion Rate Optimization focuses on making the booking process easy and fast once users click through. Mobile-friendly sites, quick loading, and simple booking flows help turn clicks into bookings.

Supporting deep linking—where users land on pages pre-filled with their search details—reduces friction and improves the experience.

Seasonal Bidding helps hotels adjust spend based on demand. Investing more during shoulder seasons or local events can capture extra bookings, while cutting back during peak times can protect margins.

Performance Analytics give hotels the insights to tweak campaigns. Key metrics include impressions, clicks, conversions, and cost per acquisition, but also assisted conversions and multi-touch attribution.

Knowing how metasearch engines differ from OTAs helps hotels make smarter distribution choices.

Who Owns the Transaction? OTAs handle the entire booking process and customer service, owning the relationship. Metasearch engines just refer users to booking sites.

This means hotels get more guest data and direct communication when bookings come through metasearch-driven direct channels.

How They Make Money differs too. OTAs take a commission (15-25%), while metasearch platforms mostly charge for advertising clicks or lower commissions.

This leads to different cost structures: OTA commissions are predictable but reduce margins; metasearch costs are upfront but can deliver cheaper bookings.

Inventory Management is simpler with metasearch since it pulls from existing hotel channels, while OTAs require direct rate loading.

User Intent and Marketing vary. OTA users often browse broadly, needing more marketing push. Metasearch users usually have clear intent, which often means higher conversion rates.

Competition on OTAs focuses on location, amenities, and reviews. On metasearch, it’s about bidding, price competitiveness, and conversion optimization.

Brand Visibility is stronger on metasearch since hotels can showcase their own brand more prominently.

Customer Service responsibilities shift too. OTAs handle guest issues; hotels must manage them directly for metasearch bookings.

Market Reach is broad on OTAs with established customer bases. Metasearch offers wide reach through partnerships but requires tailored optimization.

Balancing both channels is key. Hotels need OTAs for reach and metasearch for direct bookings. The right mix depends on each property’s goals.

The metasearch world keeps evolving fast, thanks to AI, user habits, and new tech. Hotels that stay ahead of these trends will be in a strong position.

AI-Powered Personalization is a game changer. Machine learning looks at past searches, bookings, and user behavior to tailor results. This goes beyond just sorting by price—it recommends hotels based on traveler type, loyalty programs, and more.

Hotels that provide rich, accurate data about their property will benefit the most from these smarter algorithms.

Voice Search is on the rise with smart assistants becoming household staples. Metasearch engines need to adapt to conversational queries, and hotels should optimize for voice search and featured snippets.

Mobile-First Design is essential as most travel searches happen on phones. Fast, mobile-optimized booking experiences are critical to convert metasearch traffic.

Deep linking into hotel apps is growing too, letting users book through apps directly from metasearch results.

Sustainability Filters are gaining traction as travelers care more about environmental and social impact. Metasearch platforms now highlight certifications and carbon footprints.

Hotels should showcase their green initiatives clearly to attract eco-conscious guests.

Real-Time Dynamic Pricing lets hotels update rates instantly to respond to demand and competitor moves. This requires advanced revenue management but helps stay competitive.

Augmented Reality and Virtual Tours are starting to appear, giving travelers immersive previews before booking.

Blockchain and New Loyalty Models might shake up commissions and rewards, with some platforms experimenting with crypto and secure booking verification.

Overall, metasearch engines are moving toward smarter, more personalized, and transparent platforms. Hotels investing in data, technology, and user experience will come out ahead.

Metasearch engines have reshaped how hotels connect with travelers, offering new ways to compete with OTAs and capture high-intent bookings. But success requires more than just signing up—it demands thoughtful strategy, technical know-how, and ongoing effort.

Think of metasearch as a performance marketing channel. Treat it like paid advertising, focusing on cost per acquisition, conversion rates, and competitive positioning.

Keep rate parity, content quality, and technical integration top of mind. Without these basics, even big ad budgets won’t deliver results. Once those are in place, you can explore advanced tactics like dynamic bidding, seasonal adjustments, and personalized targeting.

The future is bright with AI, mobile-first design, and personalization leading the way. Hotels that start building expertise now will be ready to thrive as these features become standard.

If you want to cut distribution costs and boost direct bookings, metasearch engines are a must-have part of your marketing mix. The question isn’t whether to join, but how to do it right.

Start by reviewing your current metasearch presence. Check your rate parity, analyze booking engine performance, and look for ways to win more direct bookings through smart metasearch optimization. Your future guests are already comparing options—make sure your best offer is the one they see first.