Guide to Hotel Payment Processing: Streamline Transactions & Revenue

Mika Takahashi

Mika Takahashi Mika Takahashi

Mika TakahashiIn today’s fast-paced hospitality world, having an efficient hotel payment processing system is essential for delivering an outstanding guest experience. With digital wallets now accounting for 15-20% of property-level transactions in major markets—and that figure climbing quickly—hotels that don’t modernize their payment processes risk losing direct bookings and loyal customers. Effective hotel payment processing goes beyond simply accepting payments; it seamlessly integrates every step of the guest journey, from online reservations to final checkout, opening up opportunities to boost revenue while cutting operational costs.

Modern travelers expect the same payment flexibility they enjoy in retail and other industries. Whether guests prefer credit and debit cards, contactless mobile payments, or new buy-now-pay-later options, hotels need to support these diverse preferences without sacrificing security or efficiency. The most successful properties understand that hotel payment processing is more than just a back-end function—it’s a strategic advantage that directly influences guest satisfaction, cash flow, and profitability.

Hotel payment processing covers the entire system and workflow that manages guest transactions across every touchpoint in the hospitality experience. Unlike standalone payment terminals, comprehensive hotel payment processing solutions connect booking engines, property management systems, and financial operations into a unified platform that handles everything—from online reservations to incidental charges like spa services.

At its core, hotel payment processing acts as the property’s financial nervous system. When guests book online, the hotel payment gateway securely captures and processes their payment details while instantly updating room availability and guest profiles in the property management system. This real-time integration eliminates manual data entry, reduces booking errors, and prevents double charges.

The payment gateway serves as a secure bridge between the hotel's systems and the broader financial network, encrypting sensitive guests payment details and routing transactions through the appropriate card networks. Payment processors facilitate the transfer of funds from the guest’s bank account to the hotel’s merchant account, typically settling transactions within 24 to 48 hours. This infrastructure allows hotels to accept payments from international guests in their own currency, automatically handling exchange rate conversions.

Thanks to real-time processing, payment authorizations, room charges, and inventory updates happen instantly. When a guest checks in and provides a credit card for incidental charges, the hotel payment processing system can immediately verify card validity and place pre-authorizations without delay. Automated reconciliation ensures all transactions—from room rates to spa treatments—are accurately recorded and linked to the correct guest folio, freeing hotel staff from time-consuming manual work.

Smooth hotel payment processing depends on integrated components working together to create a seamless payment experience. Payment gateway integration acts as the digital front door for online transactions, securely processing booking confirmations while maintaining PCI compliance. These gateways handle card-not-present transactions with advanced fraud detection tools that analyze spending patterns and location data to catch suspicious bookings before they cause problems.

Point-of-sale (POS) terminals are the physical payment hubs throughout the property—from the front desk to restaurants and spa areas. Modern POS systems support features like split billing for group reservations, tip adjustments, and integration with loyalty programs that automatically apply member discounts. The latest terminals accept both chip-and-PIN and contactless payments, accommodating guests who prefer swiping cards or tapping smartphones.

Mobile payment solutions have revolutionized how guests settle bills during their stay. Instead of waiting in line at the front desk, guests can review and pay their bills through hotel apps, adding convenience and easing staff workloads during busy checkout times. These mobile platforms often sync with self-service kiosks in the lobby, offering guests multiple hassle-free payment options.

Integration with property management systems ties all payment activity to guest profiles, room assignments, and service usage. This ensures every charge—whether a room reservation, late-night room service, or spa treatment—is automatically recorded on the guest’s folio with accurate timestamps and descriptions. Real-time data syncing means front desk staff always have up-to-date information on guest charges and payment status.

Pre-authorization and incidental charge management features protect hotels financially while giving guests spending flexibility. The system can automatically place holds on guest credit cards for estimated incidental expenses based on length of stay and past spending, then adjust authorizations as actual charges accumulate. This dynamic approach reduces declined charges for legitimate expenses while minimizing the impact on guests’ available credit.

Guests today have diverse payment preferences shaped by geography, generation, and personal habits. Major credit and debit cards remain the backbone of hotel payment processing, with Visa and Mastercard holding the largest global market share. However, hotels that rely solely on these traditional methods risk alienating valuable international travelers who prefer localized payment methods.

Digital wallets have seen explosive growth in hotel settings, with Apple Pay and Google Pay leading in North America and Europe. These contactless options appeal especially to younger travelers seeking speed and convenience. Accepting digital wallets requires NFC-enabled terminals and staff training, but the payoff includes faster transactions and happier guests. Hotels embracing these solutions often attract guests specifically looking for them.

Regional payment methods are critical for hotels welcoming international visitors. UnionPay dominates China and is essential for properties hosting Chinese tourists. JCB is popular in Japan and other Asian markets, while Maestro is favored by European guests who prefer debit transactions. Local bank transfers and regional e-wallets such as AliPay and WeChat Pay have become standard at luxury resorts and urban hotels in top tourist destinations.

Buy Now Pay Later (BNPL) services like Klarna and Sezzle are gaining popularity, especially among younger guests and those booking longer stays or packages. These services let guests split payments into installments, often interest-free for short terms. Proper integration of BNPL with hotel payment processing systems is crucial to ensure smooth authorization and settlement.

Corporate billing and virtual credit cards cater to business travelers and group bookings. Virtual cards enhance security for corporate travel programs and simplify expense management. Hotels that implement corporate billing effectively can streamline payments for business guests and accelerate cash flow through consolidated invoicing.

Cryptocurrency payments and loyalty points redemption represent cutting-edge innovations in hotel payment processing. Though still niche, some luxury and tech-forward hotels accept Bitcoin and other cryptocurrencies, especially in markets where digital currencies have gained wider acceptance. Loyalty points redemption requires tight integration between hotel payment systems and loyalty databases to verify balances and process transactions in real time.

The difference between online and in-person hotel payment processing shapes how hotels manage risk, improve conversion rates, and deliver guest experiences. Card-not-present transactions for online bookings carry higher chargeback risk, so hotels implement protections such as Address Verification System (AVS) checks, CVV validation, and fraud scoring algorithms that analyze hundreds of data points to flag suspicious bookings.

Online payment processing allows hotels to capture bookings 24/7 without staff involvement, but success depends on streamlining the booking flow to reduce cart abandonment. The best online payment processing systems offer features like saved payment methods for repeat business, one-click booking for loyalty members, and transparent fee disclosures that build guest trust. Booking engines must integrate seamlessly so guests feel confident about security and reliability.

Card-present payments at check-in and checkout come with lower interchange fees and less fraud risk but require staff training and hardware upkeep. Modern chip, tap, and PIN systems provide multiple layers of security while accommodating guest preferences for payment authentication. Smooth integration ensures payments update guest folios and room access instantly.

Mobile checkout and self-service kiosks blend online and in-person payment technologies, giving guests digital payment convenience right in the hotel. These systems require intuitive interfaces and robust security since guests using self-service may need extra guidance compared to front desk transactions.

When Komodo Resort’s team reviewed their hotel payment processing, they identified inefficiencies that were driving up costs and hurting guest satisfaction. Their setup involved multiple disconnected platforms, requiring manual reconciliation between online bookings, front desk payments, and incidental charges. This fragmentation resulted in processing fees 20% above industry norms and frequent billing errors that demanded staff intervention.

To fix this, Komodo Resort adopted Prostay Pay, Prostay’s proprietary hotel payment software designed to unify payments across all guest touchpoints while maintaining a seamless luxury experience. The system supports a wide range of payment types—from high-value suite bookings using corporate virtual cards to small incidental charges made via contactless mobile payments—all synchronized with the Prostay reservations module and automatically posted to guest folios.

The rollout started with a pilot at key locations, focusing on integration between booking engines, property management systems, and POS terminals throughout the resort. The platform records guests payment preferences during booking and shares this data across departments, enabling personalized service and smooth payment handling. Advanced pre-authorization management lets the resort tailor credit card holds based on guest profiles and expected spending, minimizing declined charges.

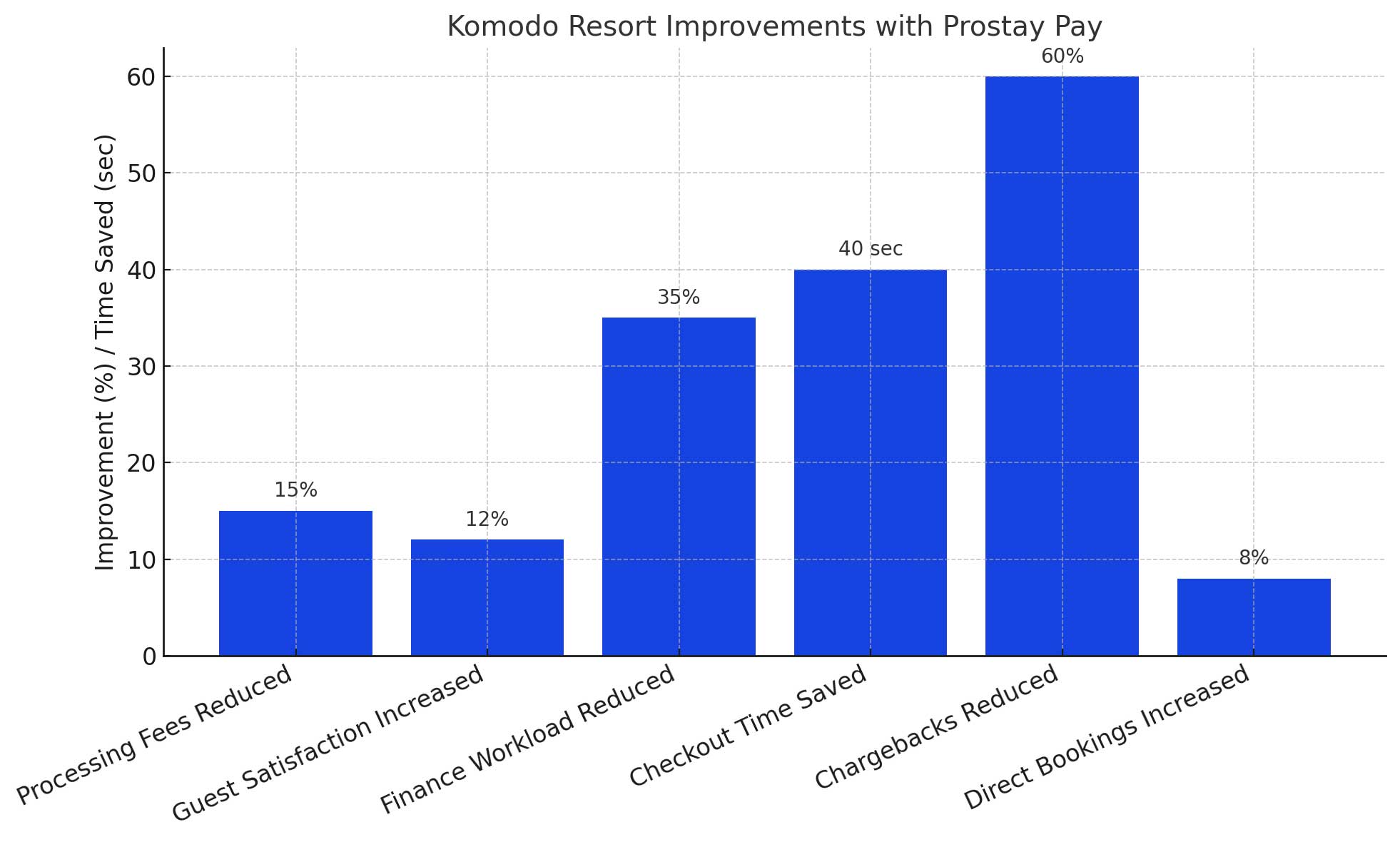

Within six months of implementing Prostay Pay, Komodo Resort cut overall processing fees by 15% through optimized transaction routing and consolidated payment data that enabled volume-based rate negotiations. Guest satisfaction rose 12%, thanks to faster checkouts and nearly eliminated billing mistakes. Automated reconciliation reduced finance team workload by 35%, freeing staff to focus on guest service and revenue growth.

Operational efficiency also improved significantly. Checkout payment times dropped by an average of 40 seconds per transaction, easing peak hour congestion. Chargeback rates fell by 60% thanks to better transaction data and automated dispute management. Most importantly, the expanded payment options and streamlined booking experience drove an 8% increase in direct bookings, as guests appreciated the flexibility and convenience Prostay Pay offered.

PCI DSS compliance forms the baseline security standard for hotel payment processing systems, but maintaining compliance requires ongoing attention to technology, staff training, and procedures. The Payment Card Industry Data Security Standard includes twelve key requirements, from network security and encryption to access controls and regular security testing. Hotels must build secure network architectures that isolate payment processing systems from other operations while still enabling seamless guest experiences.

Protecting guests payment details calls for a layered approach. Modern systems use tokenization to replace card numbers with random tokens, so even if data is breached, stolen information can’t be used fraudulently. End-to-end encryption safeguards payment data as it moves between terminals, gateways, and processors.

Fraud prevention has evolved beyond simple address checks to include advanced machine learning that analyzes transaction patterns, guest behavior, and external threats. Sophisticated fraud detection can spot suspicious booking patterns, such as multiple reservations using different cards but the same IP address, or spending habits that don’t match typical guest profiles. Three-dimensional Secure (3DS) protocols add an extra authentication step for online payments, reducing liability for card-not-present fraud while maintaining smooth customer experiences.

Managing chargebacks and disputes requires systematic documentation and response processes. The best hotel payment processing systems automatically capture transaction evidence—authorization codes, guest signatures, service confirmations—and can quickly submit dispute responses within deadlines, boosting chances of winning legitimate cases.

Regular security audits and staff training are essential to prevent human errors that could undermine technical safeguards. Quarterly vulnerability scans and annual penetration tests help identify security gaps before they are exploited. Training covers everything from spotting phishing attempts to proper handling of card data, with regular updates addressing new threats and compliance changes.

Smart pre-authorization strategies can boost guest satisfaction and improve cash flow. Instead of applying a one-size-fits-all hold, advanced hotel payment processing systems analyze guest profiles, stay length, and past spending to customize hold amounts. Business travelers with corporate cards might receive higher holds to cover expenses, while leisure guests might have lower holds that increase as charges accumulate.

Integrating payment processing with booking systems opens doors for revenue growth through targeted upselling and cross-selling. When guests provide payment information upfront, hotels can gauge their preferred payment method and spending potential to offer upgrades and add-ons. Guests using premium credit cards might receive offers for suites or exclusive experiences, while corporate card users might see business center or extended stay incentives.

Dynamic pricing tied to payment methods allows hotels to adjust rates in real time based on acceptance and processing costs. Hotels might offer cash discounts where allowed or vary prices by payment type to manage costs. This approach requires legal review and transparent guest communication but can improve margins while keeping prices competitive.

For hotel chains and management companies, centralized hotel payment processing platforms simplify managing multiple properties. These systems enable volume-based rate negotiations, standardized reporting, and reconciliation across locations. Unified payment data also enhances loyalty programs by tracking spending across properties for better rewards and tier qualification.

Understanding payment processing costs means analyzing interchange fees, processor charges, and hidden fees that affect profits. Interchange fees set by card networks vary by card type, transaction method, and industry category. Hotels can reduce processing fees by encouraging debit card use over credit cards and ensuring transactions include Level II and III data to qualify for lower rates.

Processor fees differ widely among providers, so regular market comparisons help optimize costs. Some offer transparent interchange-plus pricing, while others use tiered models that obscure true costs. Hotels should negotiate custom rates based on transaction volume and mix to save money.

Surcharge and cash discount programs can help recover processing costs but must comply with local laws and be guest-friendly to avoid harming the experience.

Annual reviews of payment providers are crucial as the market changes rapidly. Hotels should evaluate pricing, payment method support, system integration, and customer service quality.

Biometric and voice-activated payments are the next frontier, promising frictionless experiences with enhanced security. Fingerprint and facial recognition are already piloted in select luxury hotels, letting guests authorize payments without signatures or PINs. Voice-activated payments via in-room smart speakers could allow ordering room service or spa bookings with natural language commands, charging payments automatically.

Artificial intelligence goes beyond fraud detection to personalize payment experiences and predict guest preferences. AI analyzes payment histories to suggest preferred payment methods and optimize payment reminders. Machine learning can forecast who might extend stays based on payment behaviors.

Blockchain and cryptocurrency acceptance are moving from experimental to practical. Some tech-forward hotels use blockchain-based loyalty programs and accept Bitcoin for bookings. The transparency and immutability of blockchain could enable new guest verification and dispute resolution methods.

Internet of Things integration automates room charges—smart minibars, IoT parking systems, and in-room entertainment can all charge guests automatically. This reduces labor costs and provides clear, itemized billing.

Sustainable payment options and carbon offset integration reflect growing environmental awareness. Some hotels let guests add carbon offsets to bills or join environmental programs through rounded-up payments. Digital receipts and paperless billing support sustainability while cutting costs and making transactions easy to track.

Together, these trends point to a future where hotel payment processing becomes invisible to guests yet provides hotels with deep insights into preferences and spending. Success will require balancing innovation with security, convenience with privacy, and automation with personal service. Hotels investing in flexible, future-proof hotel payment processing systems today will be best positioned to seize new opportunities and deliver the seamless experiences tomorrow’s guests expect.

Modernizing hotel payment processing doesn’t just boost efficiency—it creates real competitive advantages that enhance guest satisfaction, drive revenue, and secure long-term success. As payment preferences evolve and new technologies emerge, the hotels that thrive will be those that see their payment processing not as mere infrastructure but as strategic assets shaping every part of the guest experience.