Hotel Chart of Accounts: Guide to Accounting for Hotels

Mika Takahashi

Mika Takahashi Mika Takahashi

Mika TakahashiRunning a hotel’s finances isn’t just about keeping the books balanced. With multiple revenue streams, complex day-to-day operations, and strict compliance rules, hotels need a solid financial framework to track every transaction and produce accurate reports. At the heart of this framework lies the hotel chart of accounts.

Think of the chart of accounts as the backbone of your hotel’s financial system. It organizes every financial transaction into clear categories, helping you make informed decisions and steering your business toward success. Whether you’re a hotel owner aiming to tighten financial control or a hospitality professional looking to improve your accounting practices, understanding how to set up and manage an effective chart of accounts is key to boosting your hotel’s financial performance.

In this guide, we’ll cover everything you need to know about the hotel chart of accounts—from the basics to advanced strategies that align with industry standards and generally accepted accounting principles.

Simply put, a hotel chart of accounts is a detailed list of all the accounts your hotel uses to record financial transactions. It’s a structured way for hotel managers and financial controllers to keep track of revenue, expenses, assets, and liabilities with clarity and precision.

Unlike typical business accounting, hotel accounting has its own twists. Hotels juggle guest accounts, handle advance deposits, manage multiple revenue streams all at once, and keep real-time financial data flowing across departments. The chart of accounts is what keeps all this organized while making sure you stay compliant with industry standards.

But the chart of accounts is more than just a ledger. It’s the foundation for accurate financial reporting, giving hotel accountants a clear framework to categorize every financial activity. This makes it easier to produce comprehensive financial statements—like balance sheets, income statements, and cash flow reports—that truly reflect the hotel’s financial health.

Plus, a well-built chart of accounts helps with compliance by ensuring transactions are categorized correctly according to tax rules and regulations. This reduces errors and makes audits smoother, which is a big relief for external property managers and owners who want transparency and accountability.

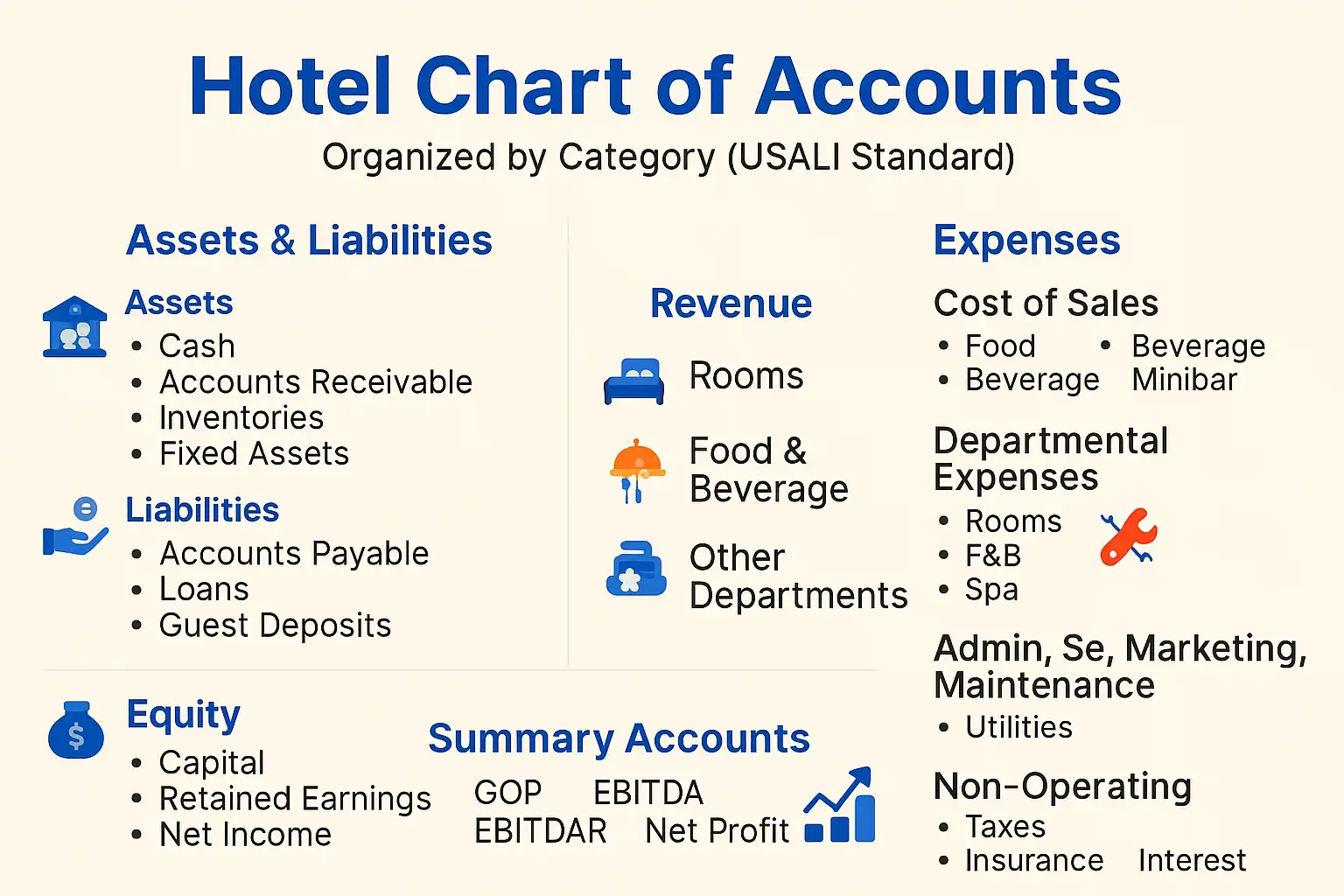

The hotel chart of accounts covers several important areas that mirror the unique operations of the hospitality business. Getting to know these components helps you manage your finances effectively and keep your hotel accounting on point.

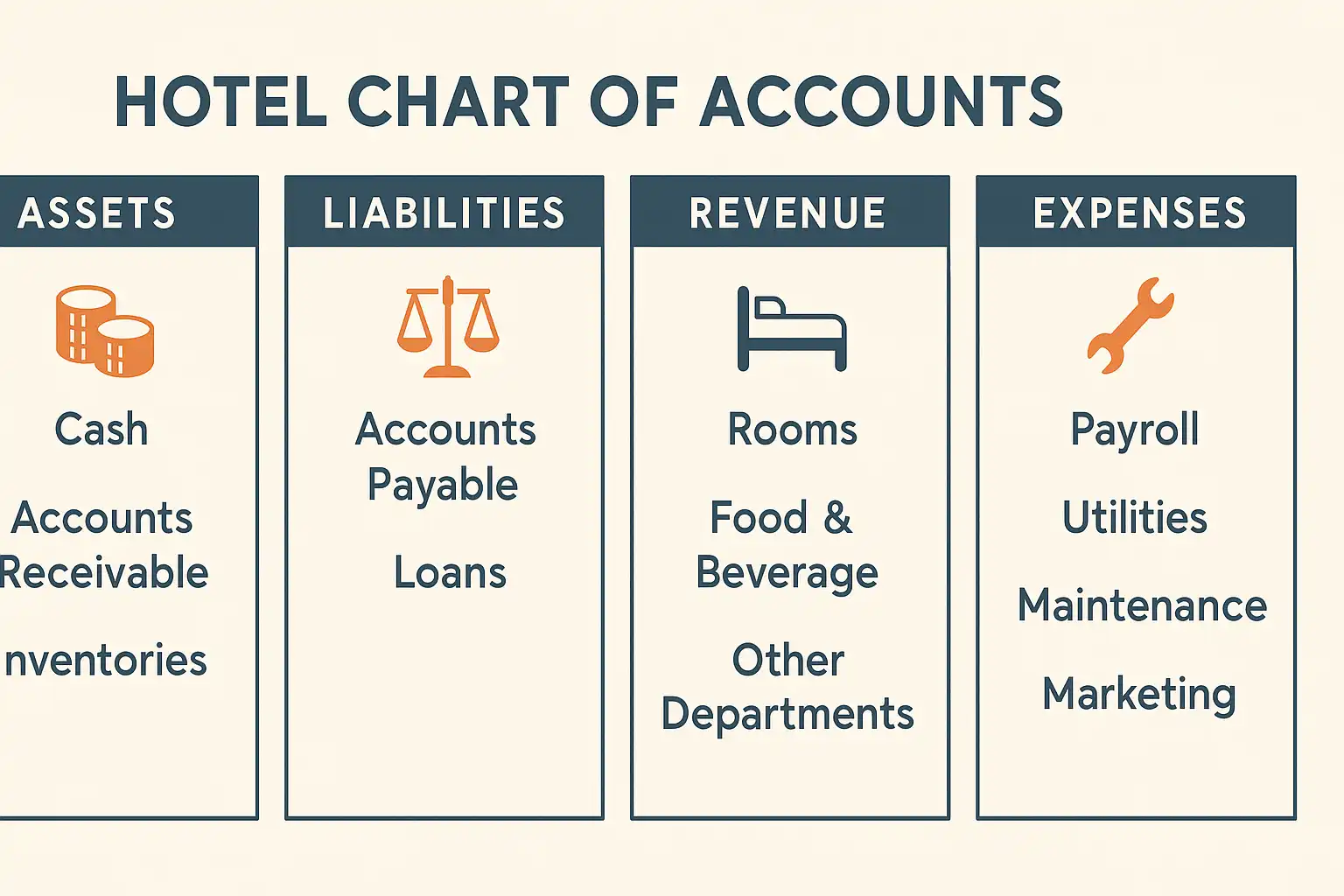

Revenue accounts are the foundation of your hotel’s financial picture, capturing income from all the different ways your hotel makes money. Room revenue usually takes the biggest slice, covering everything from individual guests to group bookings and corporate contracts. Breaking these down further by room type, rate, and season helps you forecast future revenue more accurately.

Food and beverage revenue is another major piece, including restaurant sales, bar income, room service, and catering. Tracking these separately lets you calculate your food cost percentage and beverage revenue margins, which are crucial for smart revenue management.

Don’t forget ancillary revenue streams like spa services, fitness centers, parking, retail shops, and conference facilities. These add important boosts to your gross operating profit and overall financial results.

Direct cost accounts capture expenses directly tied to revenue activities. For example, food and beverage costs include the ingredients for meals, bar supplies, and room service items. These are essential for calculating your food cost percentage and keeping each department profitable.

Operating expenses cover the everyday costs of running your hotel—things like utilities, maintenance, housekeeping supplies, and administrative costs. Labor costs make up a big chunk here, so tracking wages, benefits, and payroll taxes carefully helps you manage your labor cost percentage.

Administrative expenses include management salaries, marketing, IT, and professional fees—basically, the backbone expenses that keep your hotel running smoothly.

Asset accounts list everything your hotel owns that has value. This includes cash in hand and at the bank, money owed to you through accounts receivable, and inventory like supplies and merchandise. Property, plant, and equipment accounts cover your big investments—buildings, furniture, fixtures, and tech systems that keep operations going.

Liabilities are your hotel’s financial obligations—accounts payable to suppliers, accrued expenses, guest deposits, and long-term debts. Equity accounts show the owners’ stake in the business, including capital investments, retained earnings, and additional contributions.

The Uniform System of Accounts for the Lodging Industry (USALI) has been the hospitality industry’s go-to guide for nearly 100 years. It standardizes how hotels classify accounts, making financial reporting consistent and comparisons between properties straightforward.

By sticking to USALI, hotel managers can benchmark their performance against industry averages, spot improvement areas, and make smarter operational choices. It also makes audits easier and keeps investors and lenders confident in your financial transparency.

The latest USALI updates reflect today’s hospitality landscape, adding categories for sustainability efforts, online booking commissions, and digital marketing expenses. They also provide guidance for complex ownership models like management contracts and franchise agreements—so your accounting system can keep up with evolving business structures.

Hotels aren’t like other businesses, so their chart of accounts includes some unique categories to match their operations.

Guest accounts track everything related to individual stays—room charges, incidental expenses, deposits, and payments. These accounts handle tricky billing situations like split bills, group master accounts, and corporate direct billing.

Non-guest accounts cover transactions with suppliers, vendors, and partners—basically, all the business expenses that don’t involve guests directly.

Management accounts pull together data from departments to create reports that help managers get a clear picture of how the hotel is doing financially.

Rooms division accounts cover all revenue and expenses tied to guest accommodations—front desk, housekeeping, guest services. Tracking these in detail helps find efficiency gains and control costs.

Food and beverage accounts separate restaurant, bar, banquet, and room service operations to analyze profitability by area.

Ancillary departments like spa, fitness, and retail have their own accounts to reflect their unique revenue and cost structures.

Room revenue is often split by guest segment and rate type—transient, group, corporate, contract, and premium suites. This helps you understand how well you’re managing yields and where upselling opportunities lie.

Food and beverage revenues are broken down by outlet and service type, each with its own cost profile.

Event and conference revenues, including meeting room rentals and AV services, are tracked separately since they often have high margins.

Direct operating expenses are categorized by department for accurate cost control. Housekeeping expenses include labor and supplies; front office covers reservations and guest services; maintenance tracks repairs and upkeep.

Administrative expenses cover accounting, HR, and executive management. Sales and marketing expenses include advertising and commissions.

Fixed charges like property taxes, insurance, and depreciation are also tracked, helping you understand your hotel’s break-even point.

Management and franchise fees are recorded separately to track payments to management companies or brand licenses.

Creating a hotel chart of accounts that works means tailoring it to your property’s size, services, and growth plans—all while following industry rules.

Start by listing all your current revenue streams and thinking about future ones. A small boutique hotel won’t need the same complexity as a large resort with multiple restaurants and event spaces.

Use a logical numbering system to keep accounts easy to find. Many hotels use four or five digits, where the first digit indicates the category—like 1000s for assets, 4000s for revenue, and 5000s for expenses.

If you manage multiple properties or franchises, you might need separate charts for each location but keep them consistent for corporate reporting.

Make sure your chart of accounts integrates smoothly with your property management system (PMS), point-of-sale (POS) terminals, and other software. This helps automate data entry and keeps your financial data accurate and up-to-date.

Consider the needs of everyone who will use your reports—owners, managers, lenders—and design your accounts to support their requirements.

| Category | Account Group | Examples |

|---|---|---|

| Assets | Current Assets | Cash, Bank Accounts, Accounts Receivable, Guest Ledger, Advance Deposits |

| Inventories | Food, Beverage, Operating Supplies (linen, amenities, cleaning) | |

| Fixed Assets | Land, Buildings, FF&E, Leasehold Improvements, Accumulated Depreciation | |

| Liabilities | Current Liabilities | Accounts Payable, Accrued Expenses, Wages Payable, Taxes Payable, Guest Deposits |

| Long-Term Liabilities | Bank Loans, Lease Obligations, Bonds Payable | |

| Equity | Owner’s Equity | Capital, Retained Earnings, Net Income |

| Revenue | Rooms | Transient, Group, Corporate/Contract, Complimentary (Contra Account) |

| Food & Beverage | Restaurant Sales, Bar Sales, Banquets & Catering, Minibar, Room Service | |

| Other Departments | Spa, Parking, Telephone/Internet, Laundry, Miscellaneous Income | |

| Expenses | Cost of Sales | Food Cost, Beverage Cost, Minibar Cost, Other Department Costs |

| Rooms Department | Salaries & Wages, Employee Benefits, Cleaning Supplies, Guest Supplies | |

| F&B Department | Salaries, Employee Meals, Kitchen Supplies, Linen & Laundry | |

| Spa/Other Departments | Salaries, Supplies | |

| Admin & General | Salaries, Professional Fees, Office Supplies, Bad Debt Expense | |

| Sales & Marketing | Salaries, Advertising, Promotions, OTA Commissions | |

| Maintenance | Salaries, Repairs, Maintenance, Energy & Utilities | |

| Utilities | Electricity, Water, Gas/Heating | |

| Non-Operating | Insurance, Property Taxes, Licenses, Bank Charges, Interest | |

| Summary | Performance Metrics | Gross Operating Profit (GOP), EBITDA, EBITDAR, Net Profit |

Today’s hotels rely on seamless connections between their chart of accounts and other technology systems. This integration cuts down on manual data entry, reduces errors, and delivers real-time financial data to support smart decisions.

Your property management system (PMS) should link directly to your hotel accounting software so guest charges—like rooms, services, and incidentals—post automatically to the right revenue accounts. Payment processing, whether cash, credit cards, or direct billing, needs to update both guest folios and your accounting records at the same time.

Point-of-sale (POS) systems in restaurants, bars, and shops should also connect to your accounting system. This ensures all sales are recorded correctly, inventory is updated, and cost of goods sold calculations stay accurate.

Night audits depend on this integration to reconcile daily transactions and flag any discrepancies for quick resolution.

Handling advance deposits properly is crucial. Your system should record guest deposits as liabilities until the stay happens, then transfer them to revenue accounts as services are delivered.

Group billing and master accounts require sophisticated integration to handle individual charges while keeping the group’s master account balanced.

Keeping your chart of accounts in top shape means regular attention and good habits.

Set a schedule to review your account structure at least once a year—or whenever your operations change—to make sure it still fits your needs.

Train your staff thoroughly on how to post transactions correctly. Everyone from front desk clerks to restaurant managers needs to understand account codes.

Strong internal controls are a must. Limit who can create or change accounts, and require approvals for modifications.

Document account definitions and usage clearly. This helps maintain consistency and makes onboarding new staff easier.

Regularly reconcile subledgers—like guest accounts and inventory—with your general ledger to catch errors early.

Keep your financial data safe with backups and security measures to prevent loss or unauthorized access.

Managing a hotel chart of accounts isn’t without its hurdles.

Multiple revenue streams mean lots of transaction types. Clear coding rules and staff training help keep things organized.

Dynamic pricing, group discounts, and packages complicate revenue recognition. Automated systems that allocate revenue properly can save headaches.

Seasonal swings affect how you allocate expenses and budget. Flexible reporting systems help you adjust and stay on top.

Advance deposits create timing issues between cash receipt and revenue recognition. Proper accounting procedures keep this straight.

International properties face currency conversion challenges. Establish solid processes to handle exchange rates and keep financials accurate.

High-volume periods can overload your system. Automation and error-checking procedures keep things running smoothly.

A well-structured chart of accounts is the key to insightful financial reports that drive better decisions.

Departmental profit and loss statements show you which areas—rooms, food and beverage, spa, and more—are thriving and which need attention.

Key performance indicators like revenue per available room, average daily rate, food cost percentage, and labor cost percentage depend on accurate account categorization.

Budgeting and variance analysis become easier with organized historical data, helping you forecast better and respond to surprises.

Management reports for owners and lenders require consistent, transparent data—your chart of accounts makes this possible.

Cash flow reports benefit from detailed accounts, showing operating cash, capital expenditures, and debt service needs to help you plan ahead.

External audits go smoother when your accounts follow industry standards and have clear documentation.

Financial metrics like debt service coverage ratio rely on accurate income and expense categorization.

Effective revenue management strategies come from understanding which streams bring the best margins and how pricing affects profitability.

Net operating income and gross operating profit calculations are straightforward when expenses are properly grouped, helping you benchmark against the industry.

Assessing your hotel’s overall financial health depends on a comprehensive look at all accounts—assets, liabilities, revenue, and expenses.

Hotels with well-maintained chart of accounts often see faster, more reliable financial reporting—some reduce monthly close times by up to 30%.

As the hospitality sector evolves with new revenue streams and business models, keeping your chart of accounts flexible and organized will keep your financial control strong.

For hotel managers ready to boost their property’s financial performance, building a comprehensive chart of accounts aligned with industry standards is a crucial step. The effort you put into setup and training pays off with clearer insights, better decisions, and stronger financial control—setting your hotel up for lasting success in today’s competitive hospitality industry.