Hotel Booking Statistics: 2026 Market Insights and Trends

Mika Takahashi

Mika Takahashi Mika Takahashi

Mika TakahashiThe hotel booking world has seen some incredible changes in recent years. Thanks to new technology, shifting traveler preferences, and the industry's bounce-back from global disruptions, 2026 is shaping up to be an exciting year. Whether you're a corporate travel manager or someone working in the tourism sector, getting a handle on the latest data is more important than ever.

This article dives deep into the freshest hotel booking statistics, covering everything from market performance and channel effectiveness to the emerging trends that are changing how modern travelers find and book their stays. From the booming mobile travel booking market to the growing demand for sustainable travel options, these insights paint a vivid picture of today’s hospitality scene.

The global hotel booking market has shown impressive resilience and growth. In 2024, the industry was valued at a whopping $523 billion. Experts expect this number to soar to $1.3 trillion by 2030, growing at a healthy compound annual growth rate of 13.1%. This growth highlights the strong recovery and expansion of the travel and tourism market.

A major player in hotel tech market as a booking engine and channel manager, processes over 235 bookings every single minute worldwide—adding up to more than 125 million bookings each year across 20 different platforms. That’s a lot of travelers securing rooms digitally!

When it comes to recovery compared to pre-pandemic days, things vary quite a bit by location. Globally, occupancy rates hit 72% in 2025—8 percentage points higher than in 2019. Urban hotspots like New York City are leading the pack with an impressive 87.9% occupancy. Meanwhile, cities like New Orleans and Houston are still catching up, hovering around 60%.

Big names like Booking.com still dominate the online travel booking space, but regional platforms in Latin America and other emerging markets are gaining ground by tailoring their strategies to local travelers.

Looking at where bookings come from, online travel agencies (OTAs) currently hold about 55% of the market share. Direct bookings through hotel websites and Global Distribution Systems (GDS) make up the rest.

Hotels are putting more effort into their websites, and it’s paying off. Direct bookings jumped in 2024, and since hotels don’t have to pay hefty commissions (usually 15-25%) to OTAs, these direct reservations often bring in more profit.

| Booking Channel | Market Share | Average Commission | Revenue Impact |

|---|---|---|---|

| Online Travel Agencies | 55% | 15-25% | Moderate |

| Direct Hotel Websites | 25% | 0% | High |

| Global Distribution Systems | 15% | 10-15% | Moderate |

| Other Channels | 5% | Variable | Low |

Platforms like Trip.com have expanded internationally, while CTM Sleep Space and HRS Australasia are making waves in their regions. The competition is fierce, and technology improvements and geographic expansion are key to staying ahead.

Corporate travel planners are leaning more on platforms that sync with expense management tools, while leisure travelers prefer sites with plenty of reviews and flexible cancellation options. This split means hotels tailor their marketing differently for business and leisure travelers.

Looking at average daily rates (ADR) from 2019 through 2024, the hotel industry’s pricing power is steadily climbing. In 2025, the ADR hit $162.16—a 1.99% increase compared to the year prior—which shows steady confidence in the market.

When breaking down revenue per available room by booking source, direct bookings consistently bring higher average values than OTAs. This difference reflects the mix of customers using each channel and the pricing strategies hotels apply.

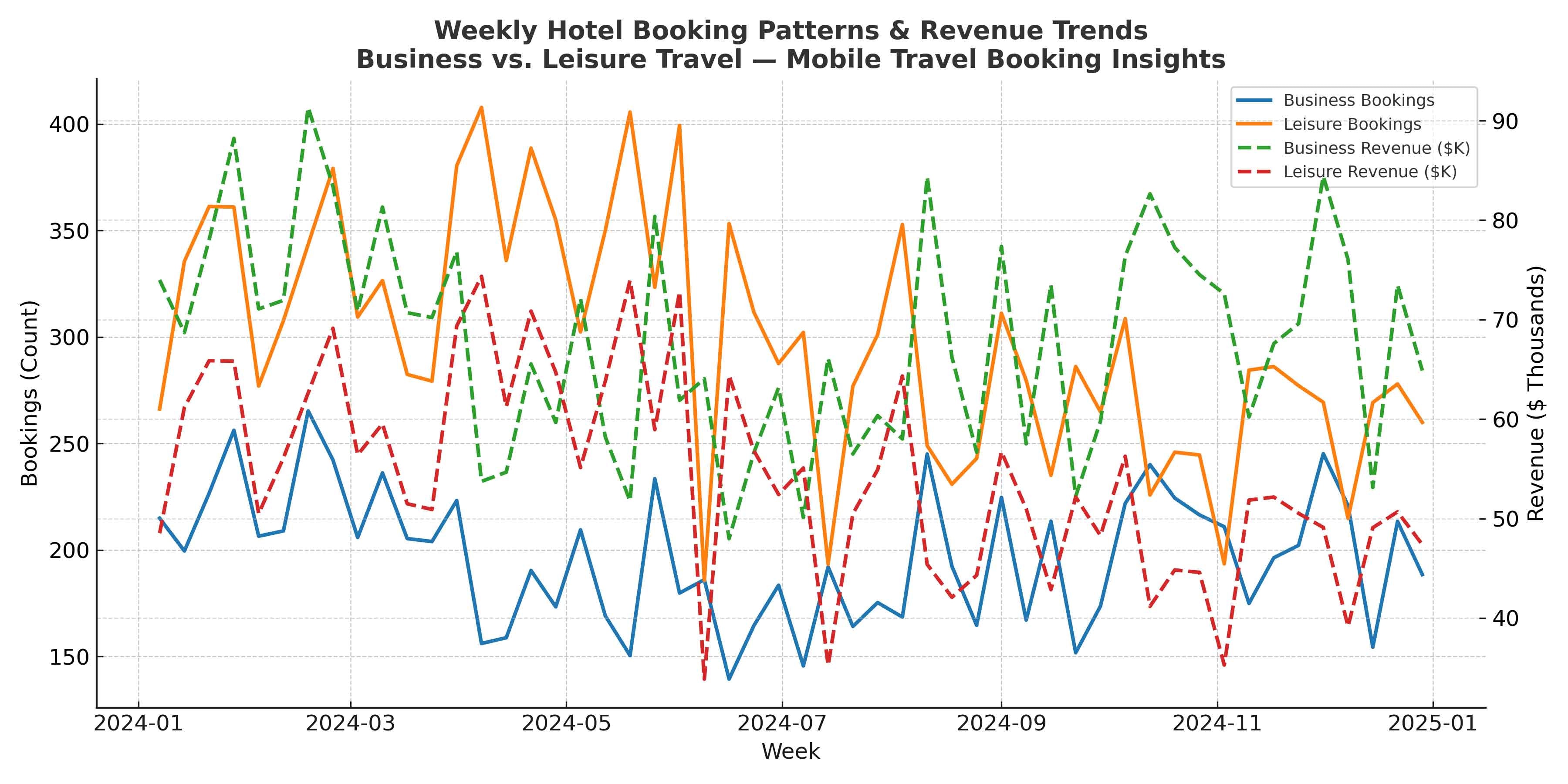

Weekly ADR trends show that weekends usually bring in 15-20% higher rates than weekdays. This pattern is common across most markets, although business-heavy destinations might see different trends during busy corporate travel times.

| Booking Platform | Average Booking Value | Conversion Rate | Customer Segment |

|---|---|---|---|

| Direct Hotel Sites | $195 | 3.8% | Mixed |

| Booking.com | $175 | 3.2% | Leisure-focused |

| Expedia | $168 | 2.9% | Mixed |

| Corporate Platforms | $210 | 4.1% | Business |

Business travelers tend to spend more, with average bookings at $180 per night versus $145 for leisure travelers. This spending gap helps hotels focus their marketing and service efforts on these distinct groups.

Booking lead times vary widely by region. Countries like Australia, the USA, and the UK tend to book well in advance. Interestingly, 87% of travelers now prefer booking online over traditional methods, showing just how digital the process has become.

Mobile bookings made up 60% of all hotel reservations in 2024—a clear sign that the mobile travel booking market is booming. Hotels are responding by enhancing their mobile experiences and rolling out dedicated travel apps.

Last-minute bookings—those made within a week of arrival—account for 35% of reservations. This trend reflects travelers' growing flexibility and confidence in finding rooms online quickly.

Business travelers usually stay around 2.3 days, while leisure visitors linger longer, averaging 4.7 days. Hotels use this data to tailor pricing and operations for each segment.

Same-day bookings are also on the rise, thanks to mobile tech. Many travelers now book while en route, especially in cities with ample accommodation options.

The mobile travel booking market is exploding. Booking.com’s app alone saw 66 million downloads worldwide in 2024, highlighting the critical role mobile plays in hotel bookings.

Mobile devices now drive 60% of all hotel reservations, with last-minute bookings on smartphones up by 36% compared to the previous year. This growth shows that phones are the go-to for travelers on the move.

Mobile conversion rates average 3.2%, slightly higher than desktop’s 2.8%. This suggests mobile users are not just browsing—they’re booking.

Frequent travelers often prefer apps for their advanced features and personalization, while casual travelers lean toward mobile web for quick access.

Hotels are investing in mobile-friendly designs, easy checkout, and features like mobile check-in and keyless room entry to keep up with this trend and encourage repeat bookings.

Guest arrivals fluctuate throughout the year, with summer months (June to August) accounting for 35% of annual check-ins. This peak season brings great revenue but also operational challenges.

Comparing 2023 to 2024, peak season has stretched into September, and spring bookings have picked up, reflecting evolving travel habits and growing confidence.

Amadeus Demand360® data shows strong forward bookings for holidays in 2025, with numbers up compared to the same period in the prior year.

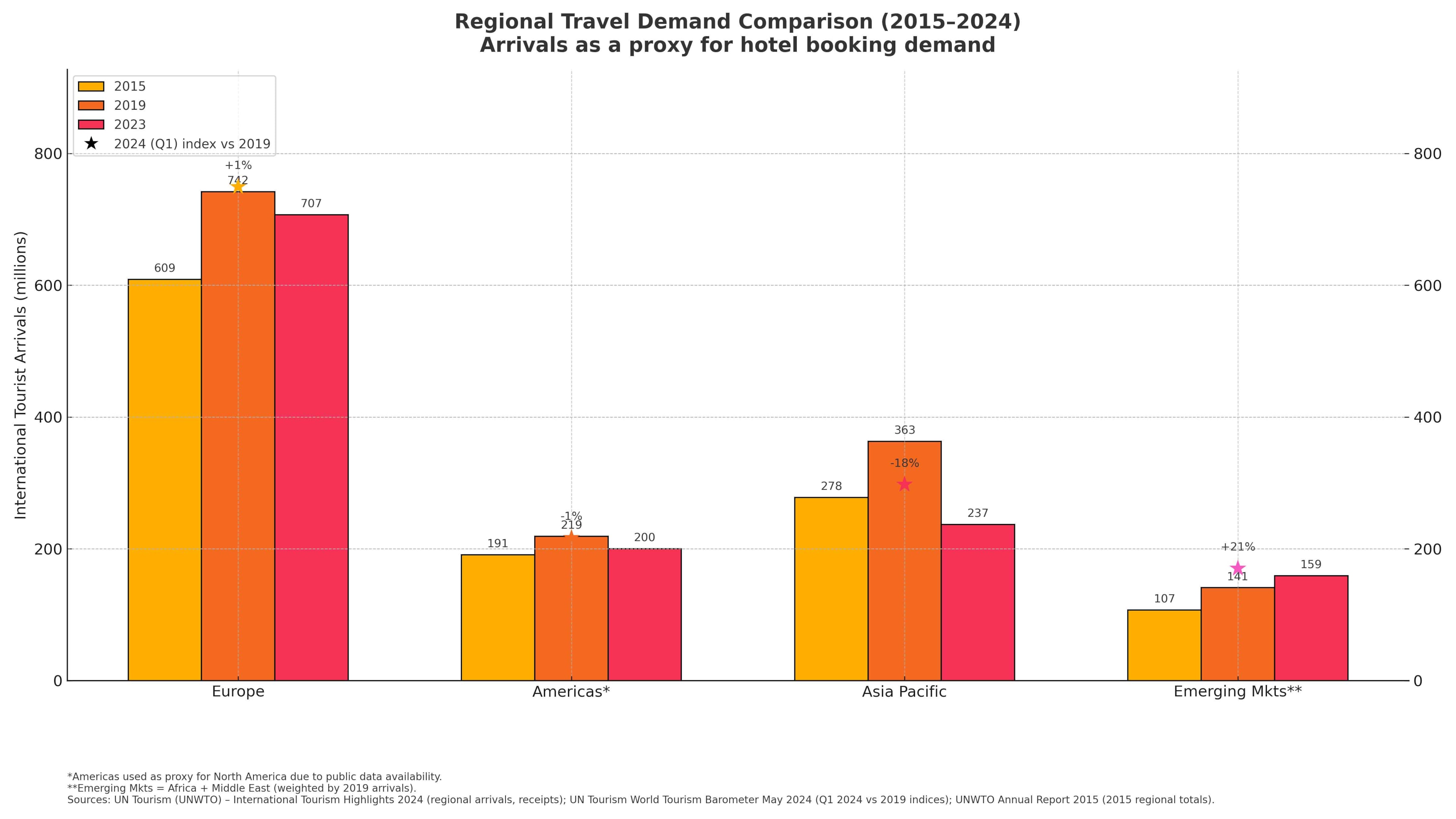

Seasonality varies by region: Europe sees sharp summer peaks, while Asia Pacific enjoys more balanced demand year-round.

Business travel helps stabilize weekday occupancy, balancing out leisure travel spikes on weekends and holidays.

Business travel has bounced back to 85% of pre-pandemic levels—a steady recovery that corporate travel managers welcome.

The bleisure market, where business trips blend with leisure, is expected to double by 2032. Many business travelers are extending their stays to enjoy some downtime, influencing hotel offerings and booking trends.

Group and corporate bookings are strong drivers of US hotel revenue, with meetings and event bookings up 28% in 2024. In-person conferences are back in full swing, boosting both room nights and ancillary spending.

Average booking values clearly separate business and leisure travelers: $180 per night for corporate guests versus $145 for leisure.

Corporate travel planners focus on policy compliance and cost control, balancing budget limits with traveler satisfaction.

Environmental concerns are shaping booking decisions. Travelers are willing to pay about 12% more for hotels with sustainable options, showing increased awareness of travel's environmental footprint.

Eco-certified hotels enjoy 23% higher booking conversion rates than those without certifications—proof that green credentials pay off.

Corporate travel programs are weaving sustainability into their policies, tracking carbon footprints, and encouraging eco-friendly choices.

Millennials, in particular, are influenced by green certifications, with 67% factoring this into their booking decisions. This group is pushing the industry toward more sustainable practices.

Carbon footprint tracking is becoming a standard feature in business travel booking tools, helping companies meet their environmental goals. This trend is expected to spread into leisure bookings, too.

AI personalization is changing how travelers book hotels. Platforms use AI to analyze preferences and past behavior to offer tailored recommendations and pricing, boosting satisfaction and conversions.

Contactless check-in is now available at 78% of hotels, offering convenience and reducing front desk contact—something guests appreciate post-pandemic.

Voice booking is catching on, with 23% of frequent travelers using it. As voice assistants improve, this method is set to grow.

Blockchain is enhancing booking security, reducing fraud, and making transactions more transparent for hotels and guests alike.

Virtual and augmented reality tools let guests tour rooms virtually before booking, cutting cancellations by 15% as expectations become clearer.

The top 10 global markets lead weekly booking demand, with established destinations holding strong and emerging markets growing fast. North America commands 35% of global hotel booking revenue, thanks to its market size and high average booking values.

Asia Pacific is the fastest-growing region at 18% year-over-year, fueled by economic recovery, domestic travel, and rising international tourism. This region offers plenty of opportunities for hoteliers and booking platforms.

Europe holds steady with 28% market share and a strong recovery across its diverse destinations.

Latin America and the Caribbean are booming, with 25% booking growth thanks to better economies and tourism promotion.

| Region | Market Share | Growth Rate | Key Characteristics |

|---|---|---|---|

| North America | 35% | 8% | High ADR, business focus |

| Europe | 28% | 12% | Diverse markets, seasonal |

| Asia Pacific | 25% | 18% | Rapid growth, mobile-first |

| Latin America | 8% | 25% | Emerging opportunities |

| Other Regions | 4% | 15% | Developing markets |

Booking channel preferences differ by region, with some areas favoring local platforms and others sticking to global brands. Hotels must understand these nuances to succeed internationally.

Cart abandonment is a big hurdle, with 87% of hotel bookings left unfinished. This shows how tricky travel planning can be and how competitive the booking space is.

Policy non-compliance affects 42% of corporate travelers, causing headaches for both travelers and travel managers. Companies are investing in better tools and training to fix this.

Rising accommodation costs hit 73% of travel budgets, forcing tough choices about how often and where to travel. Value and promotions are more important than ever.

The sheer number of options leads to booking delays for 38% of travelers. To help, platforms are turning to AI and better filters to simplify choices.

Last-minute cancellations cost hotels $2.1 billion yearly. Hotels are using smarter revenue management and flexible policies to reduce these losses.

Staff shortages plague the industry too, with nearly 65% of US hotels reporting labor gaps in 2025. This impacts service and guest satisfaction.

Looking ahead, the market is expected to keep growing, reaching $1.3 trillion by 2030. This will be driven by rising global wealth, better transport, and travelers wanting more experience-focused stays.

Mobile-first booking is set to dominate with 75% market share by 2026. Hotels and platforms must keep investing in mobile tech and seamless user experiences.

Dynamic pricing and subscription models are changing how bookings happen, letting hotels maximize revenue and travelers find flexible deals.

Smart room tech and IoT are becoming booking factors, as guests want connected, personalized stays. Hotels embracing these innovations will have an edge.

Personalization and sustainable travel will continue to shape hotel operations and booking platforms. Success means balancing tech advances with environmental and guest experience priorities.

Automation, data analytics, and new traveler segments like digital nomads will bring both challenges and opportunities.

The tourism sector’s digital transformation will speed up, with AI, machine learning, and advanced analytics becoming standard tools. Hotels that adopt these while focusing on guest needs will thrive.

As travelers become more sophisticated, the hotel booking industry must keep evolving—offering seamless tech, eco-friendly options, and personal touches. These stats provide a solid foundation to understand the market and prepare for the future in this fast-changing industry.